This report is the third in which the UEFA Intelligence Centre has showcased European club football competitions specifically and the successes and challenges of the talent competing within them.

It goes beyond the headlines to provide granularity on subjects such as match attendance, transfer trends, player usage and head coaches.

The UEFA Intelligence Centre landscape reports have long brought transparency to European football in support of evidence-based planning and policymaking. If you love football, why not explore further?

01

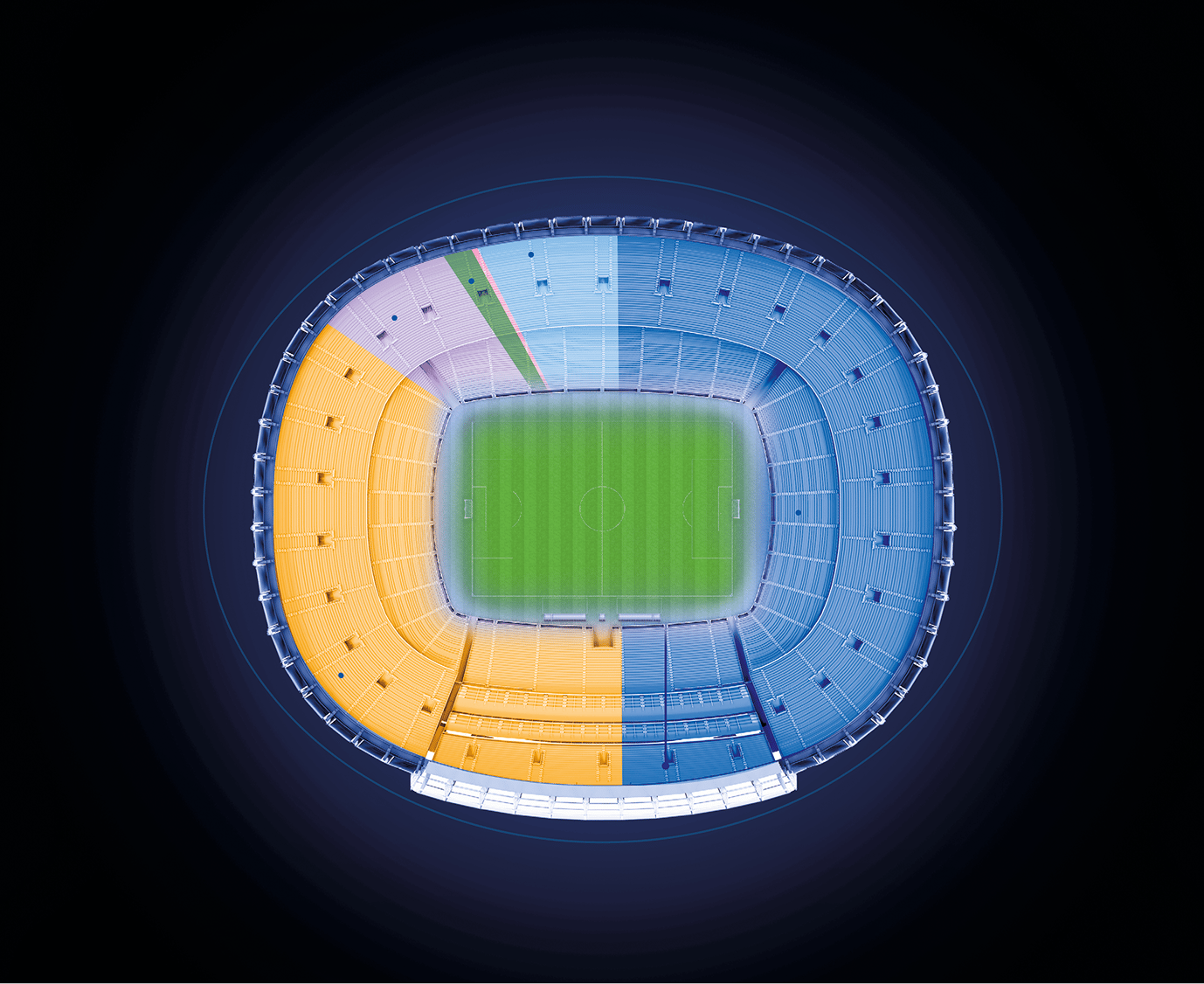

Attendance

Attendance growth across European football with all-time record crowds recorded in men’s top-tier competitions, lower-tier competitions and UEFA club competitions during 2024/25.

In a world where more matches are televised and more online content is available than ever before, the appetite for live experiences is stronger than ever.

14 million

[+2.8%]

Men’s domestic cup crowds

0.5 million

UEFA Women’s

Champions League crowds

4.0 million

Women’s domestic

club competition crowds

20 million

[+13%]

Men’s UEFA club

competition crowds

81 million

[+0.7%]

Men’s lower-tier professional

league crowds

114 million

[+2.5%]

Men’s top-tier league crowds

Unprecedented attendance levels in European club football

Hover over the plus markers to view spectator figures by competition

Hover and hold the plus markers to view spectator figures by competition

227 million

spectators at European football matches in 2024/25 (club football and national team crowds)

17 leagues

recorded their biggest crowds in at least a decade

35 clubs

enjoyed home attendance of more than 1 million

More than

80 million people

attended lower-league matches beyond the top tier

02

Competitions

European football calendars and formats continue to evolve. UEFA stands alongside all other stakeholders to proudly protect the European sports model and the pyramid structure that connects grassroots football to the elite club game.

Promotion and relegation generate suspense and keep things real at all levels of the European football pyramid

1,220

different clubs

have played in their top-tier league in the last decade

The final UEFA Conference League spot is decided by a post-season

play-off in ten top tiers, adding suspense to the end of the domestic league season

Domestic cups remain a vibrant part of the calendar, with 86 clubs outside the top tier reaching at least the quarter-finals last season

A majority of countries had a change of league champion in 2024/25, with the lowest number of repeat winners since 2010/11

210+

170+

80+

72

140+

130+

110+

78

80+

90+

65+

70

60+

20+

10+

20

Top tier

712 clubs

Second tier

805 clubs

Third tier

1,530+ clubs

Fourth tier

2,880+ clubs

Fifth tier

4,380 + clubs

DIRECT PROMOTION

Qualify for promotion play-offs

DIRECT RELEGATION

Qualify for relegation play-offs

03

TRANSFER

TRENDS

This summer’s transfer window saw further record investment, reflecting confidence in the European club football market on the back of record club revenues.

Average deal prices paid increased in most major transfer markets with the high average transfer fee in the Premier League highlighting the dominance of English clubs.

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season.

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season.

European lower-tier matches bring 76 million fans in attendance

Top tier

Third tier

Fourth tier

Fifth tier

Amateur level

Second tier

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season

Amateur level

Fifth tier

Fourth tier

Third tier

Second tier

Top tier

European lower-tier matches bring 76 million fans in attendance

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season.

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season.

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season

Amateur level

Fifth tier

Fourth tier

Third tier

Second tier

Top tier

European lower-tier matches bring 76 million fans in attendance

English Championship

23,000 Average spectators per match

2nd Highest average league attendance in world football last season

2. Bundesliga

29,000

Average spectators per match

4th Highest average league attendance in world football last season

Top tier

Third tier

Fourth tier

Fifth tier

Amateur level

European lower-tier matches bring 72 million fans in attendance

2. BUNDESLIGA

Average of over 29,000 spectators per match

4th highest average league attendance in world football last season

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match

2nd highest aggregate league attendance in world football last season

ENGLISH CHAMPIONSHIP

Average of over 23,000 specattors per match.

2nd highest aggregate league attendance in world football last season.

2. BUNDESLIGA

Average of over 29,000 spectators per match.

4th highest average league attendance in world football last season.

Second tier

European lower-tier matches bring

65 million

fans in attendance

European lower-tier matches bring

74,999,900

fans in attendance

Lorem ipsum dolor sit amet

RECORD EARNINGS

39% increase

From last summers’ transfer earnings, with Saudi Arabian transfer spending helping European clubs earn more than ever before

TREND OF INVESTMENT IN YOUTH

68%

Of all transfers fees invested in players 23 or younger - a decade ago the share was less than 50%

ENG FLOW / LIQUIDITY

€2.7 billion

estimated English club gross transfer spend. Almost exactly the same as the other ‘big5’ countries combined.

KSA FLOW

€800 million

Saudi Arabian club net spend, joining the English clubs in providing a second large source of transfer profits for talent developers. All other major markets were net earners during the summer.

€6.1m

Average price paid by Big 5 clubs for inbound senior players

Average fees increase in most of the major transfer markets (16/20)

€21.5m

€5.5m

€4.8m

€3.6m

€3.7m

Average price of inbound senior players in summer transfer windows (€m), top 20 leagues by spend

25%

Average price increase in top 20 leagues

(compared with summer 2024)

+42%

+35%

+18%

+17%

-22%

+102%

+76%

+146%

+19%

+38%

+24%

+25%

+240%

+45%

-17%

-11%

+304%

+29%

+21%

-35%

Value (€m)

League

Change since summer 2024

22.2

6.2

5.5

4.3

4.2

1.9

1.5

1.4

1.3

1.2

1.0

0.69

0.48

0.43

0.41

0.37

0.25

0.23

0.15

0.14

ENG

GER

ITA

ESP

FRA

TUR

POR

NED

ENG

(2nd tier)

RUS

BEL

DEN

UKR

GRE

SCO

AUT

POL

GER

(2nd tier)

ESP

(2nd tier)

ITA

(2nd tier)

55% of all transfer fees were invested in players aged 23 and under

The prices for full backs and attacking/wide midfielders have increased the most of any position this summer – players selling for 64% more than the price of their previous transfers

04

TALENT

The report compiles data on squad regulation and player usage, which then informs discussions about player workload, match calendars, competition formats and rules, competitive balance and transfer and finance regulations. The report also provides a unique review of the head coach landscape.

Clubs are adapting to workload pressures by spreading match time across more players, using their full subs allocation and rotating their squads.

15.5

Average number of players fielded by each club during their league season

1,456

more players fielded in domestic top-tier leagues than in 2019/20 (before the five subs rule)

7%

of first-team squad players featured in over 30 league matches

700

head coach

changes

less than one change per top-division club for the first time in the last decade

head coaches

The most in-demand head coaches working abroad in top-level football

ESP

ITA

POR

06

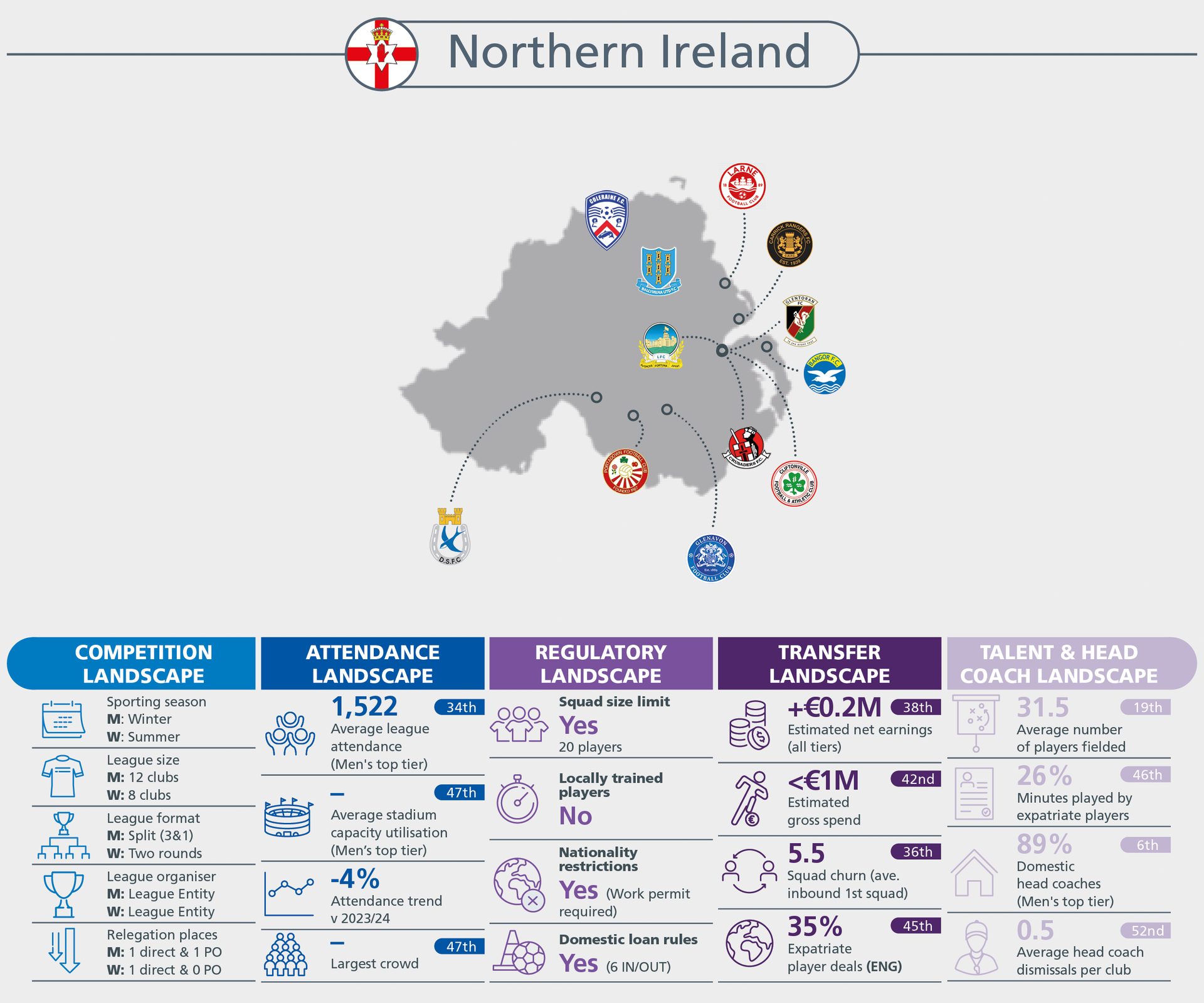

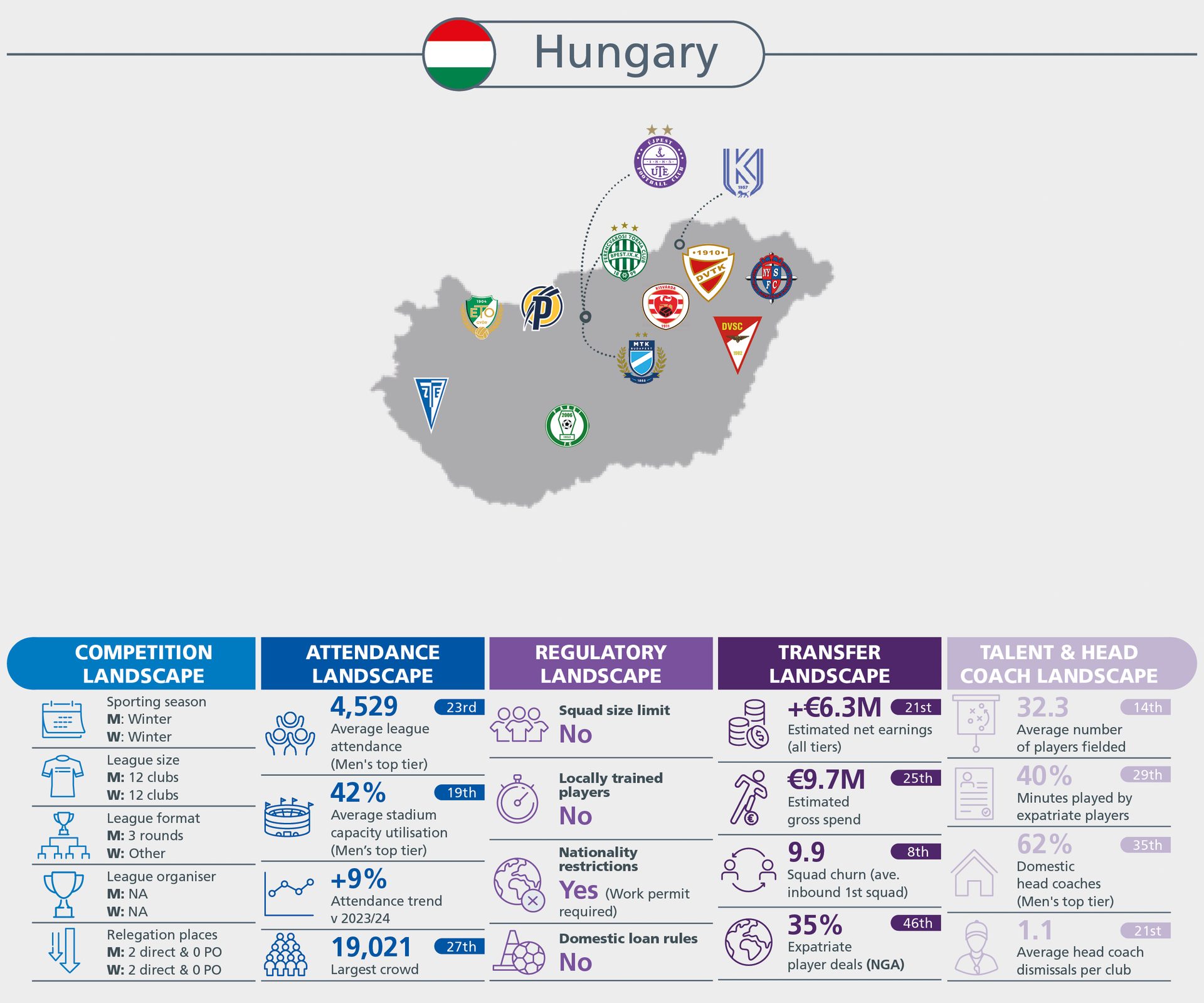

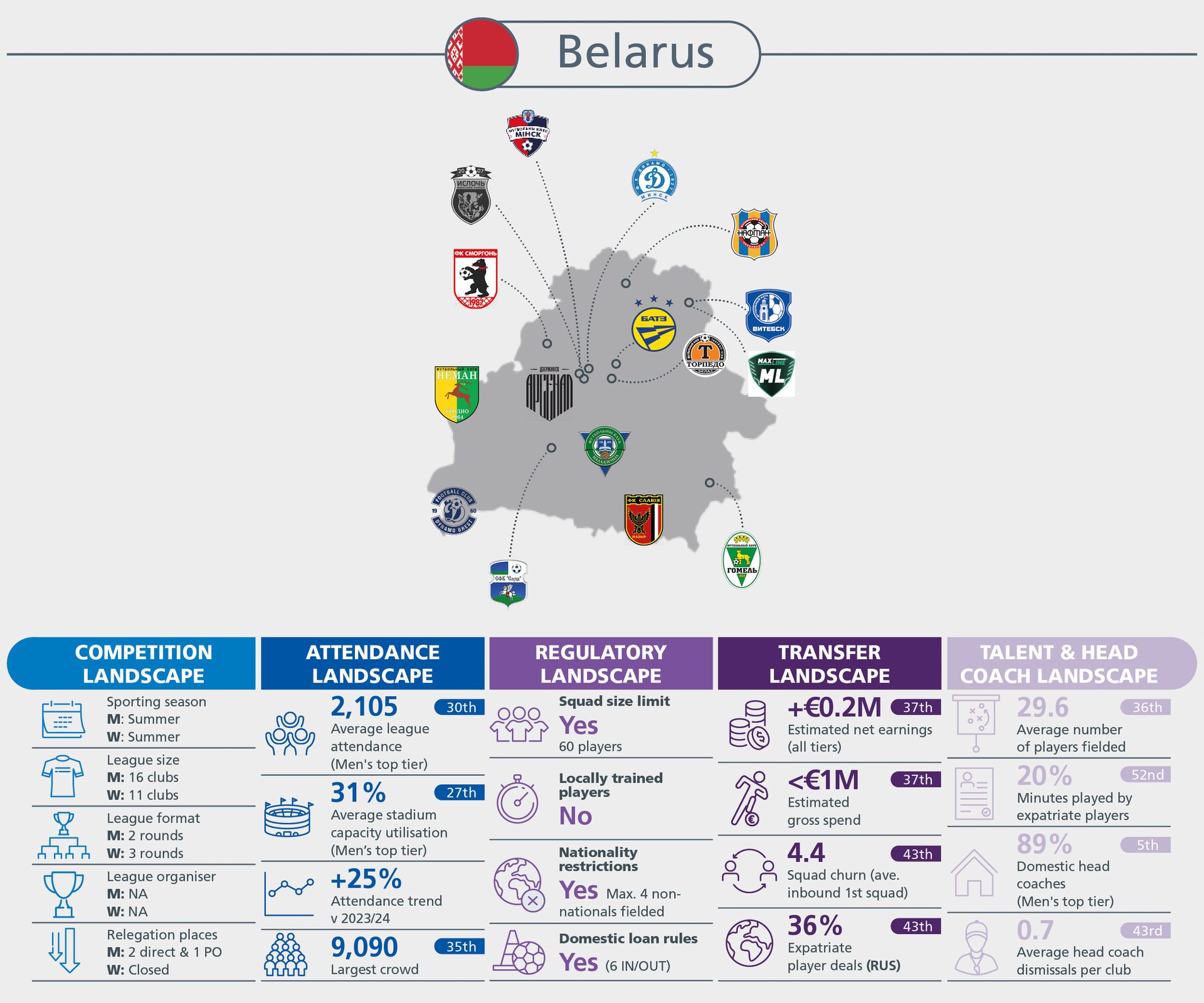

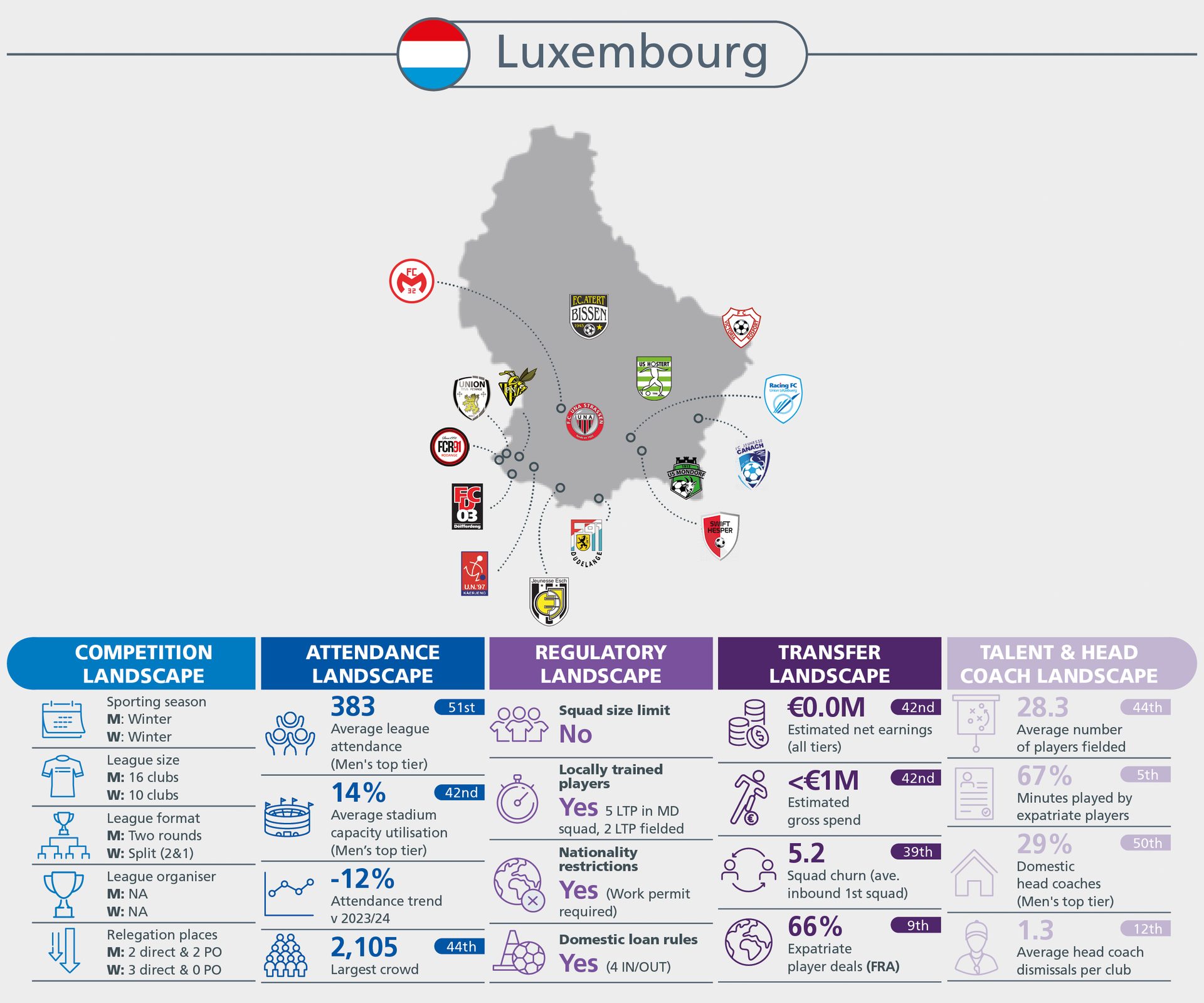

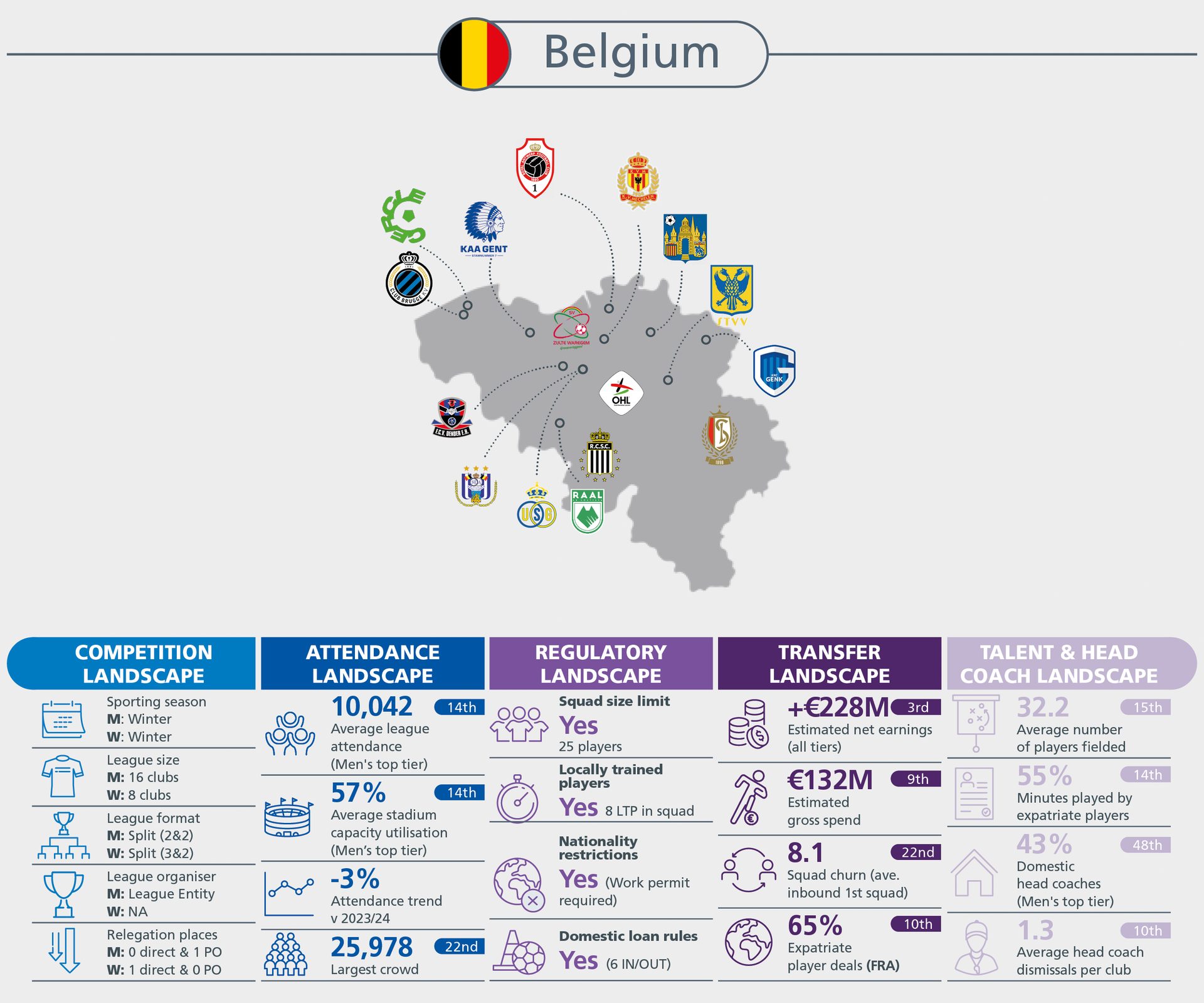

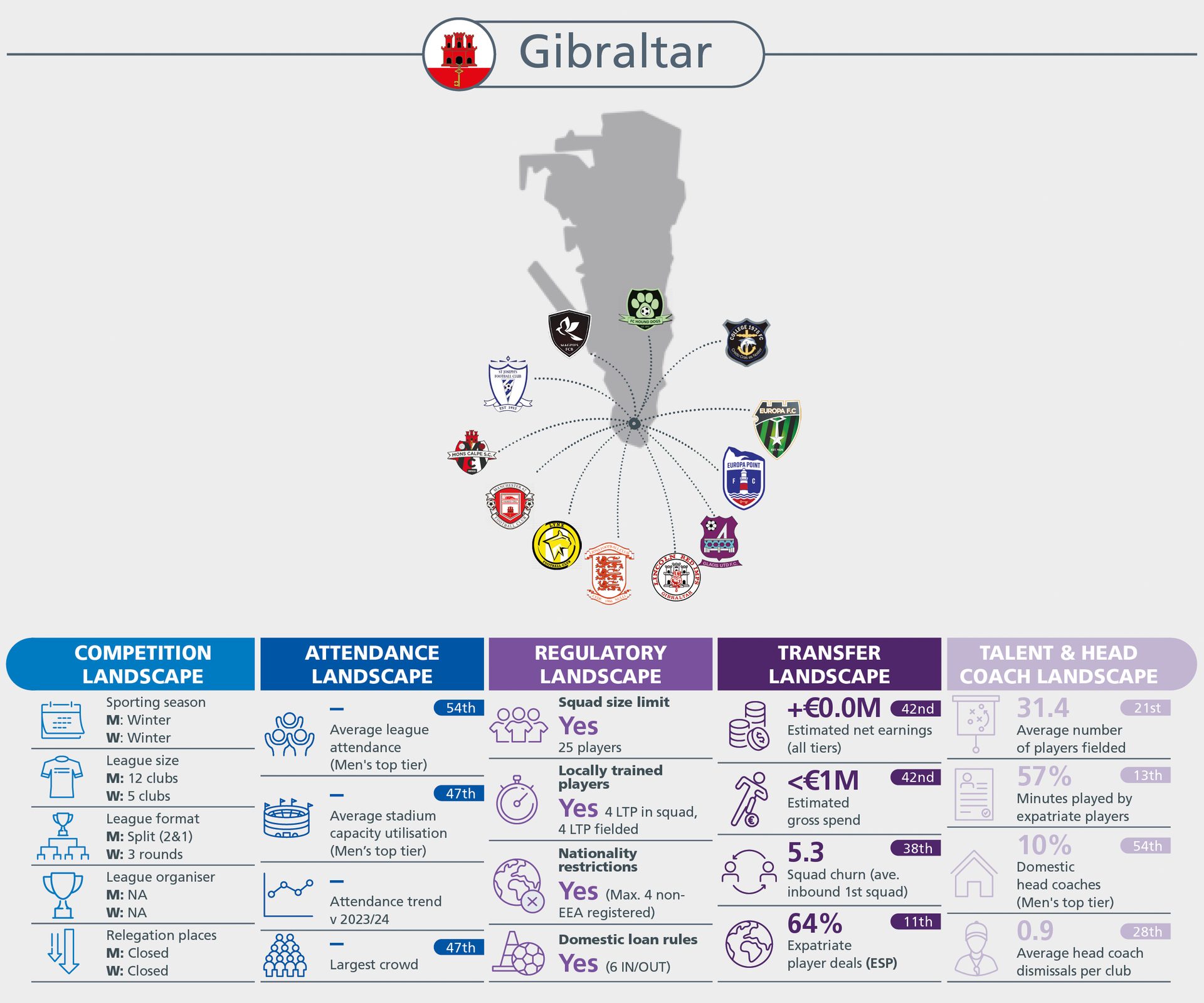

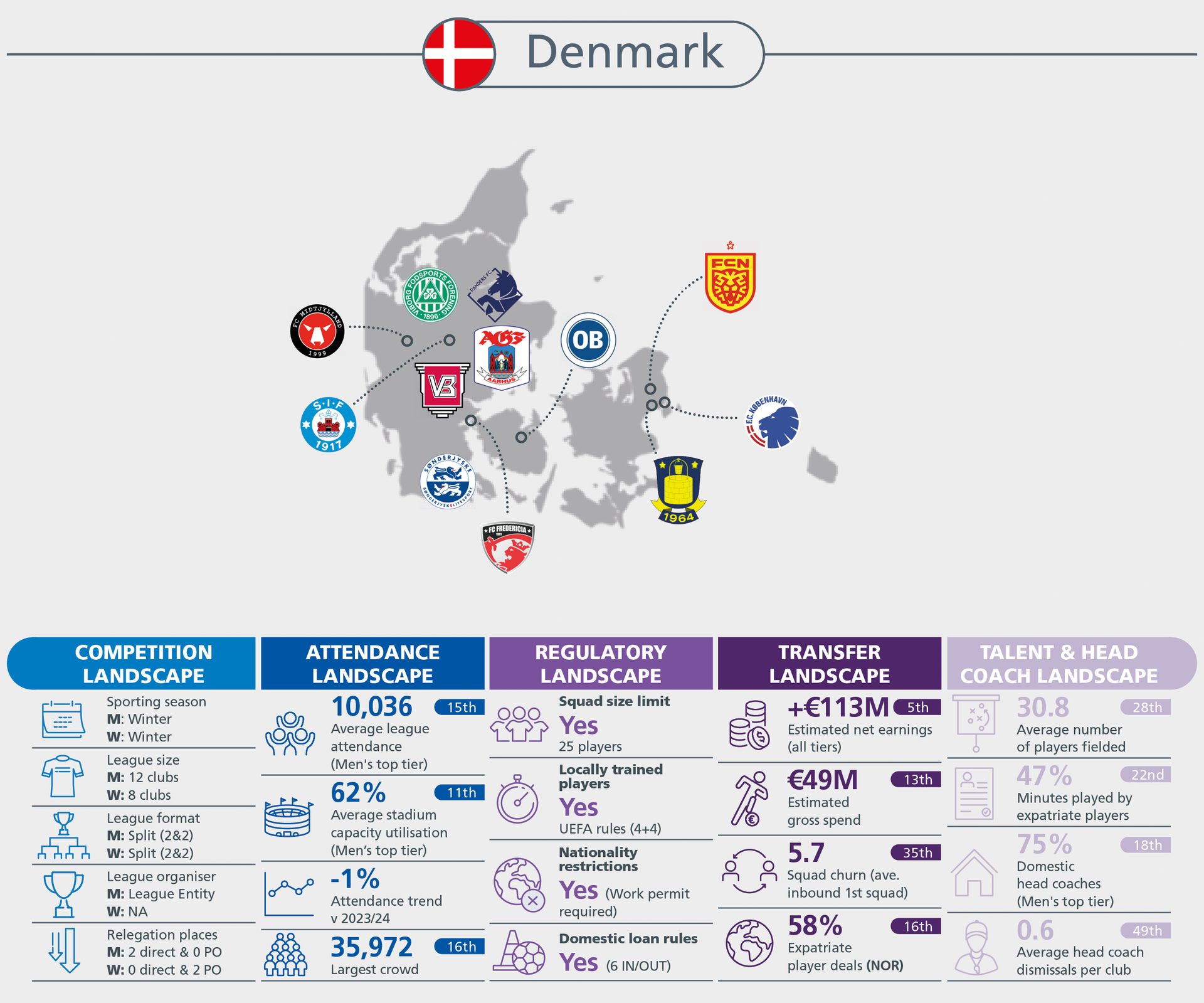

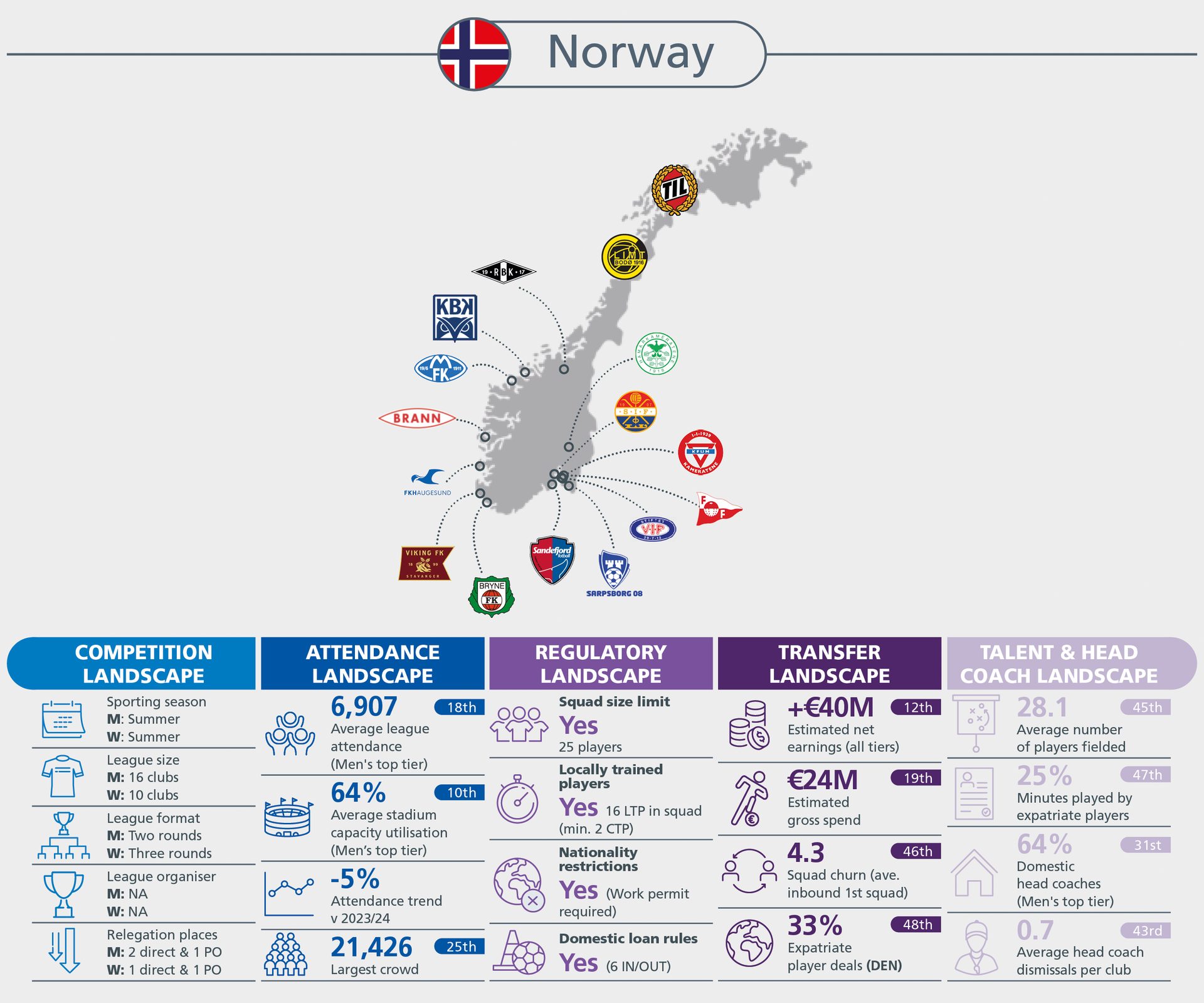

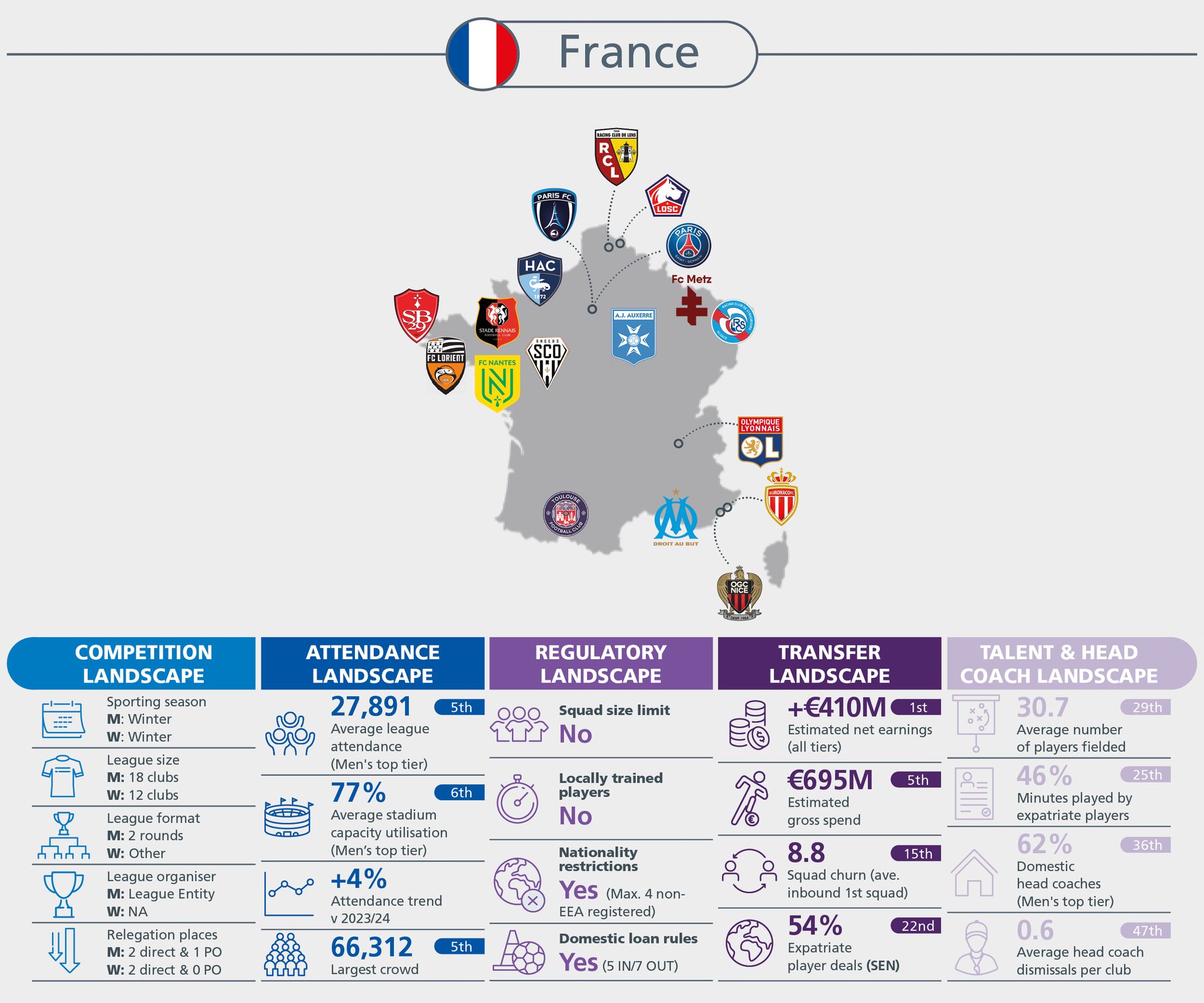

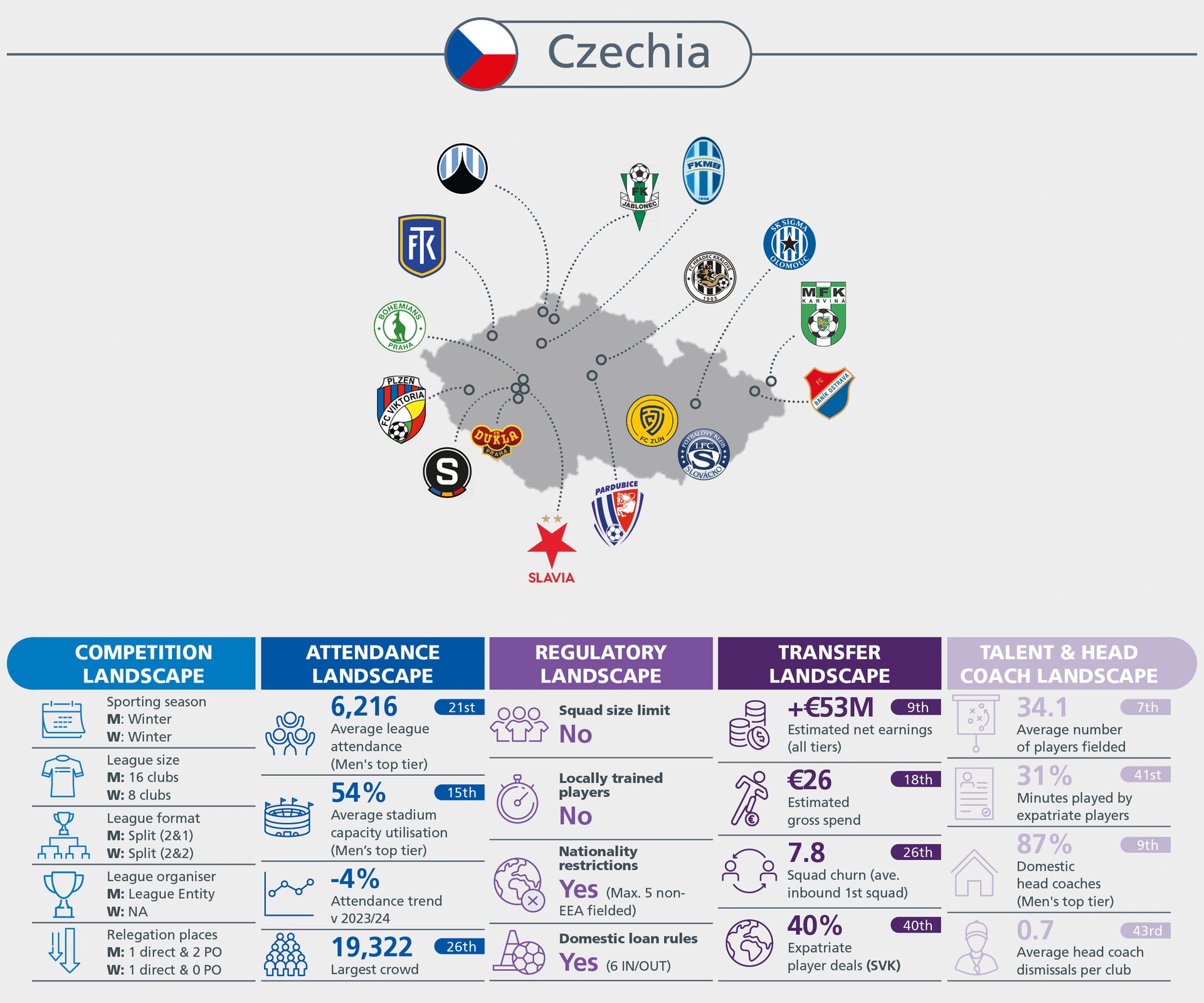

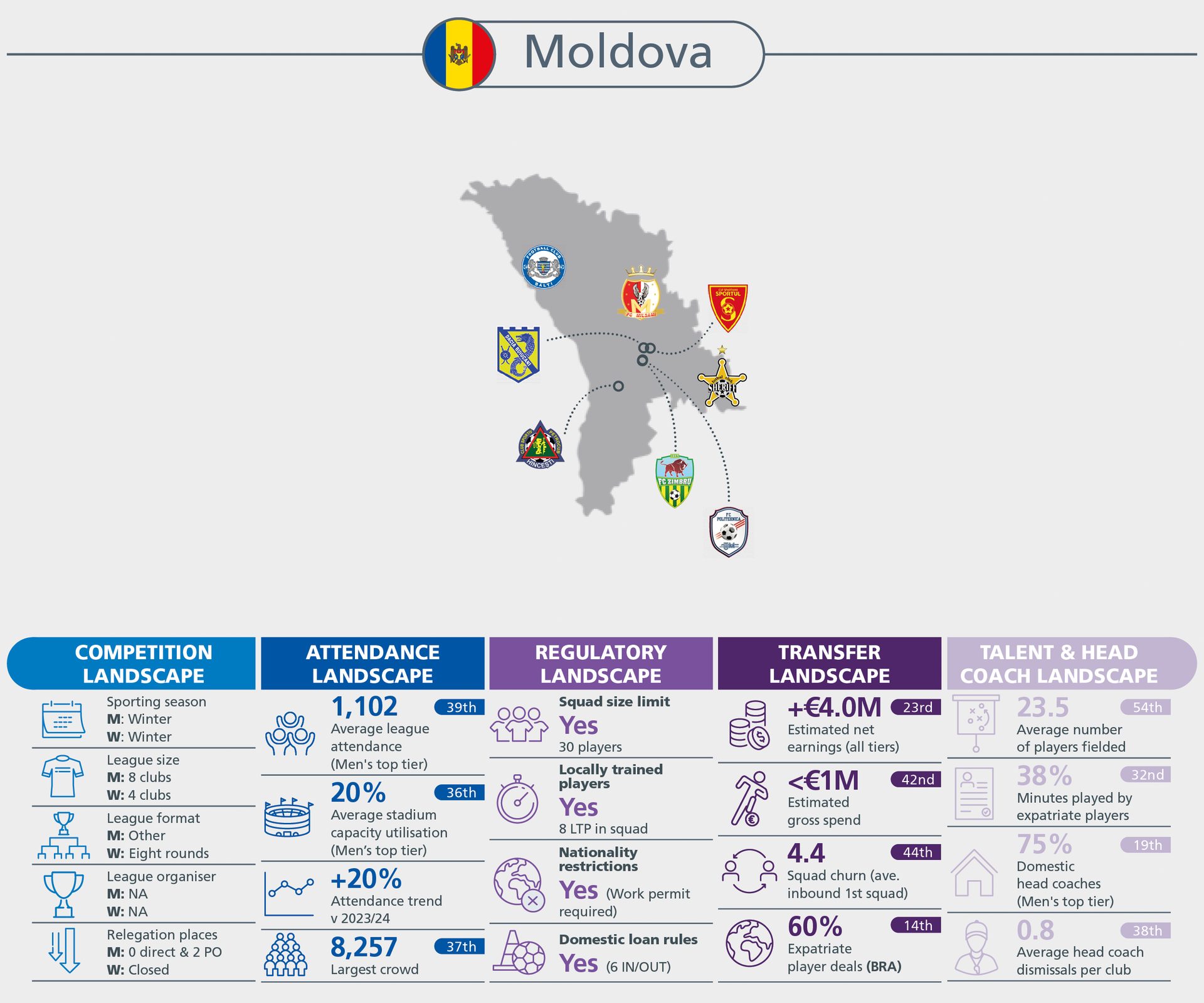

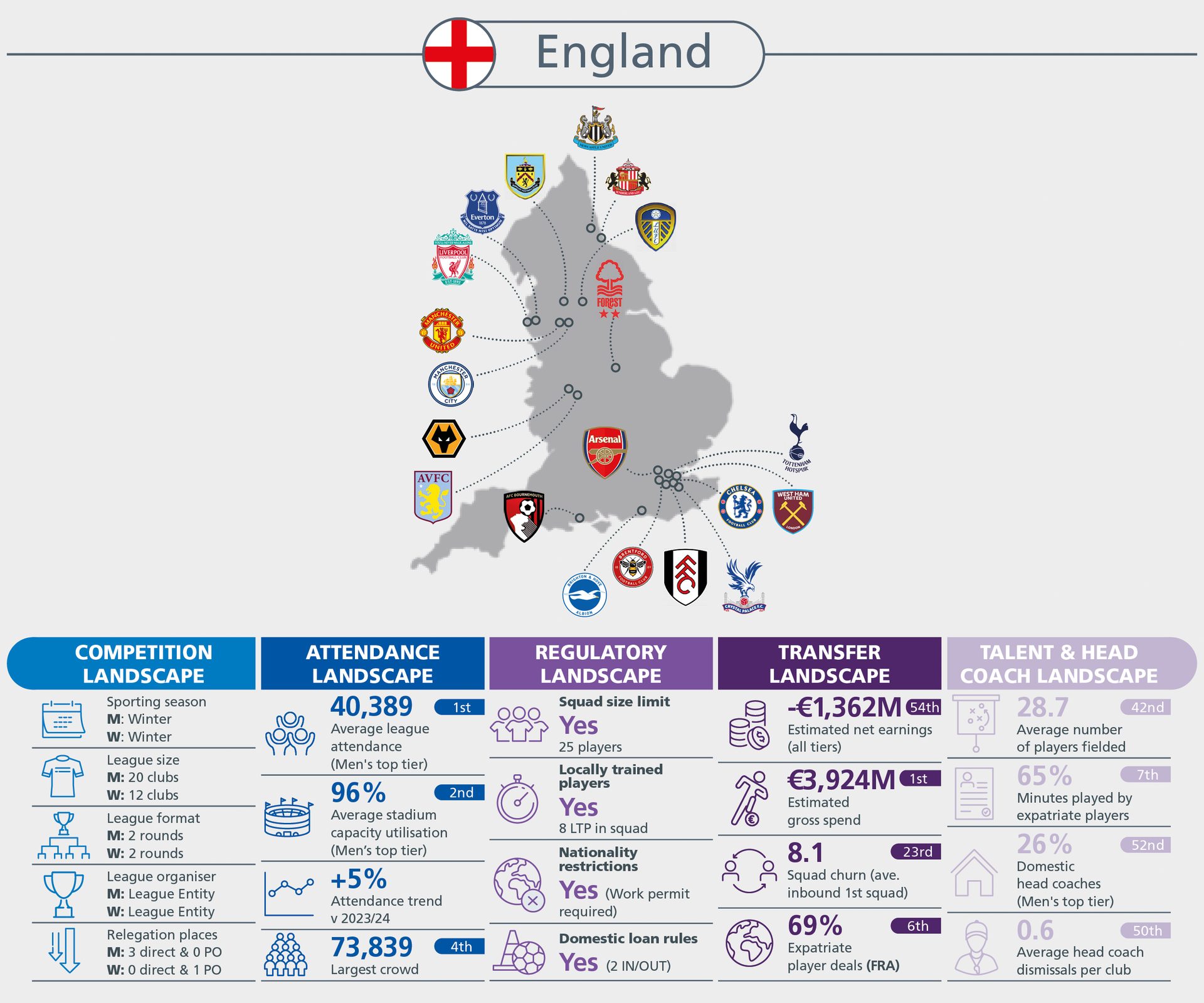

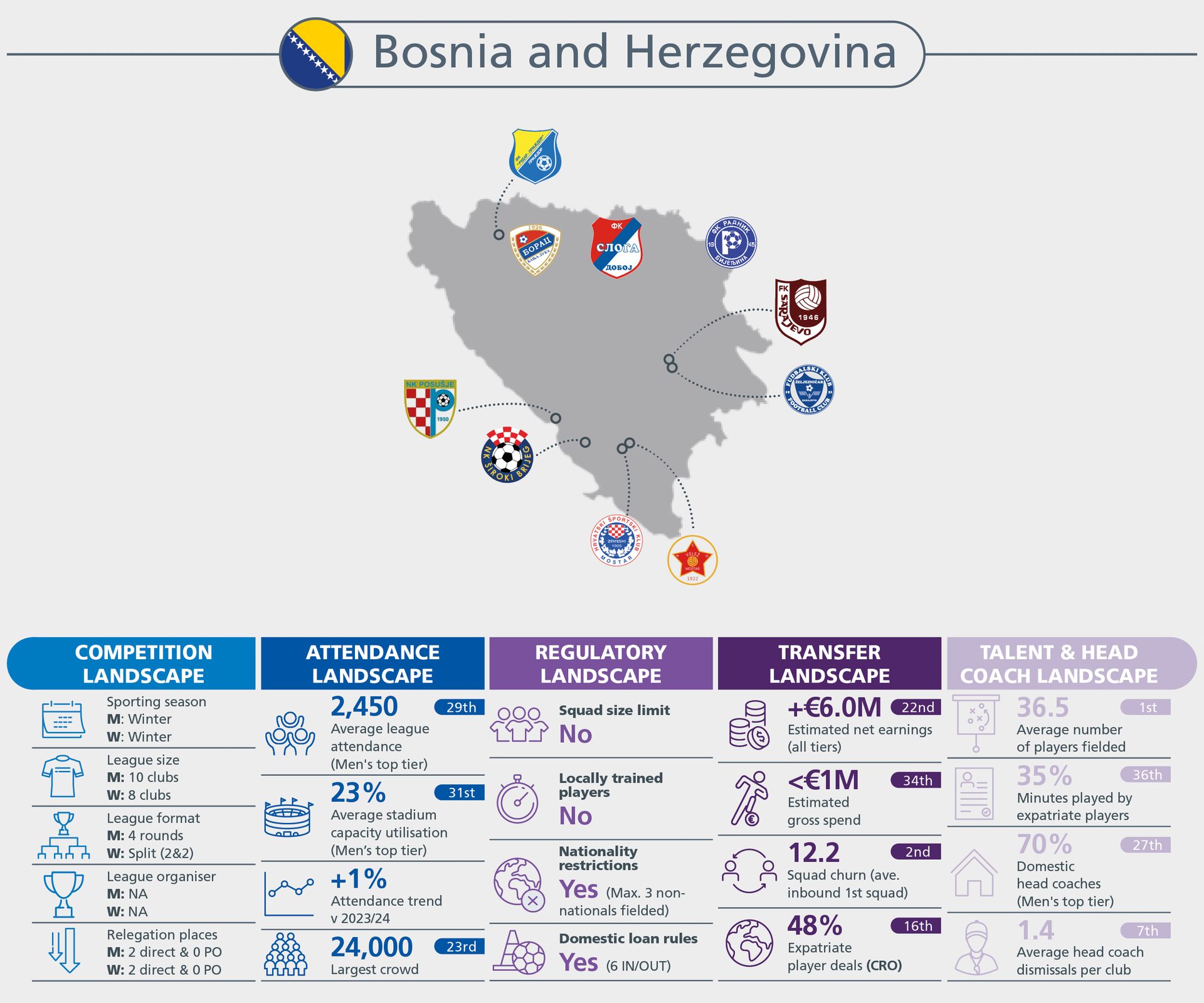

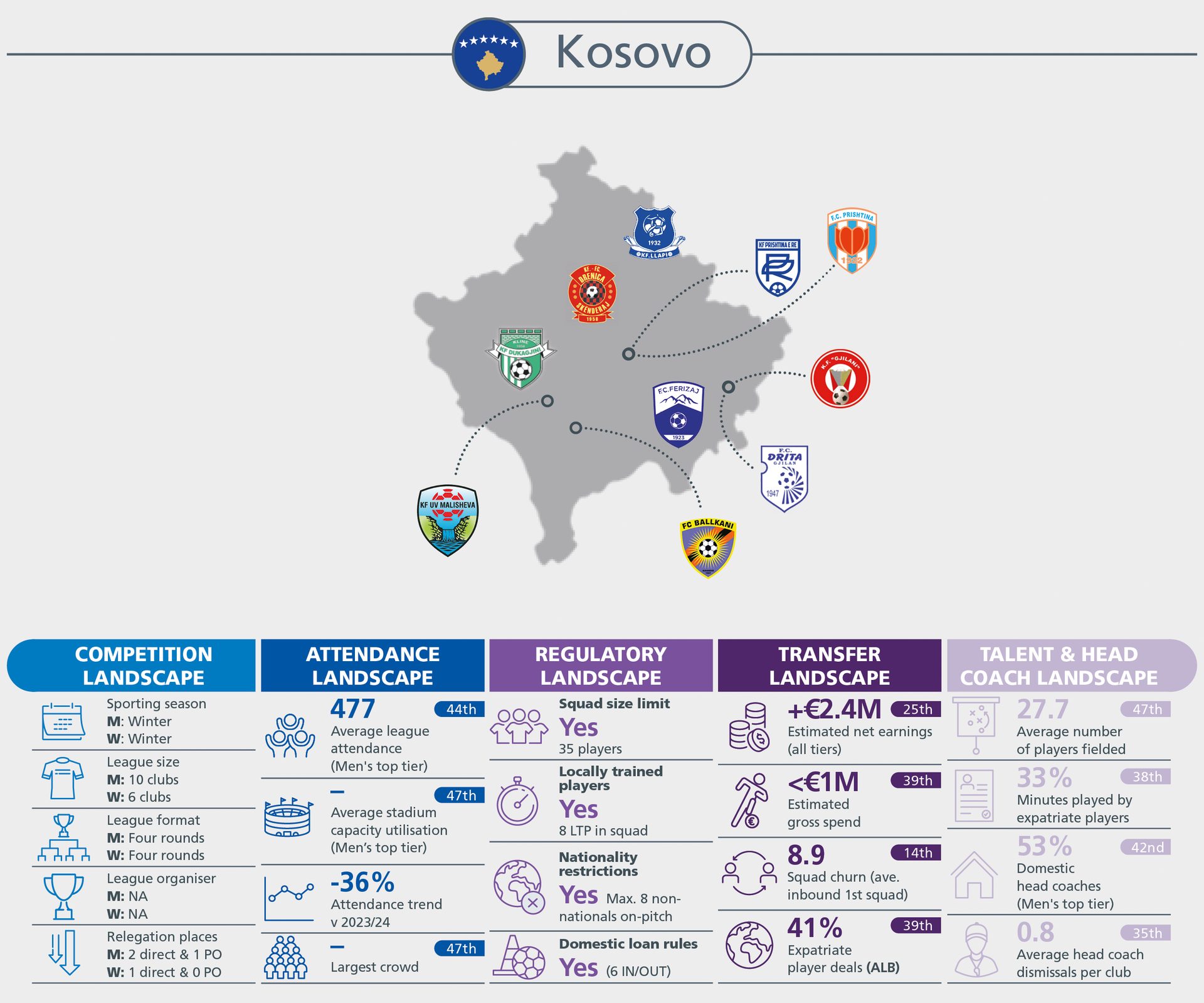

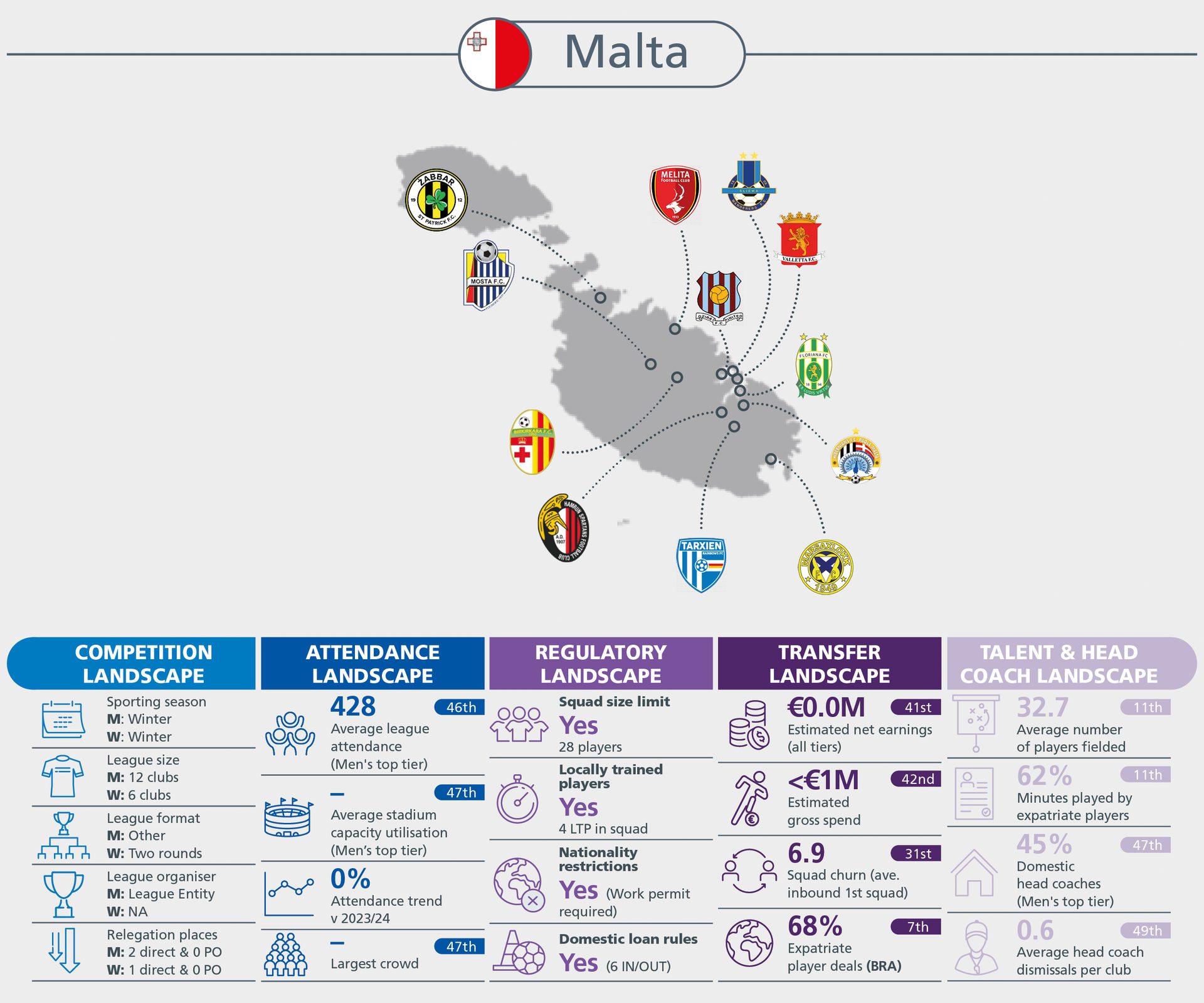

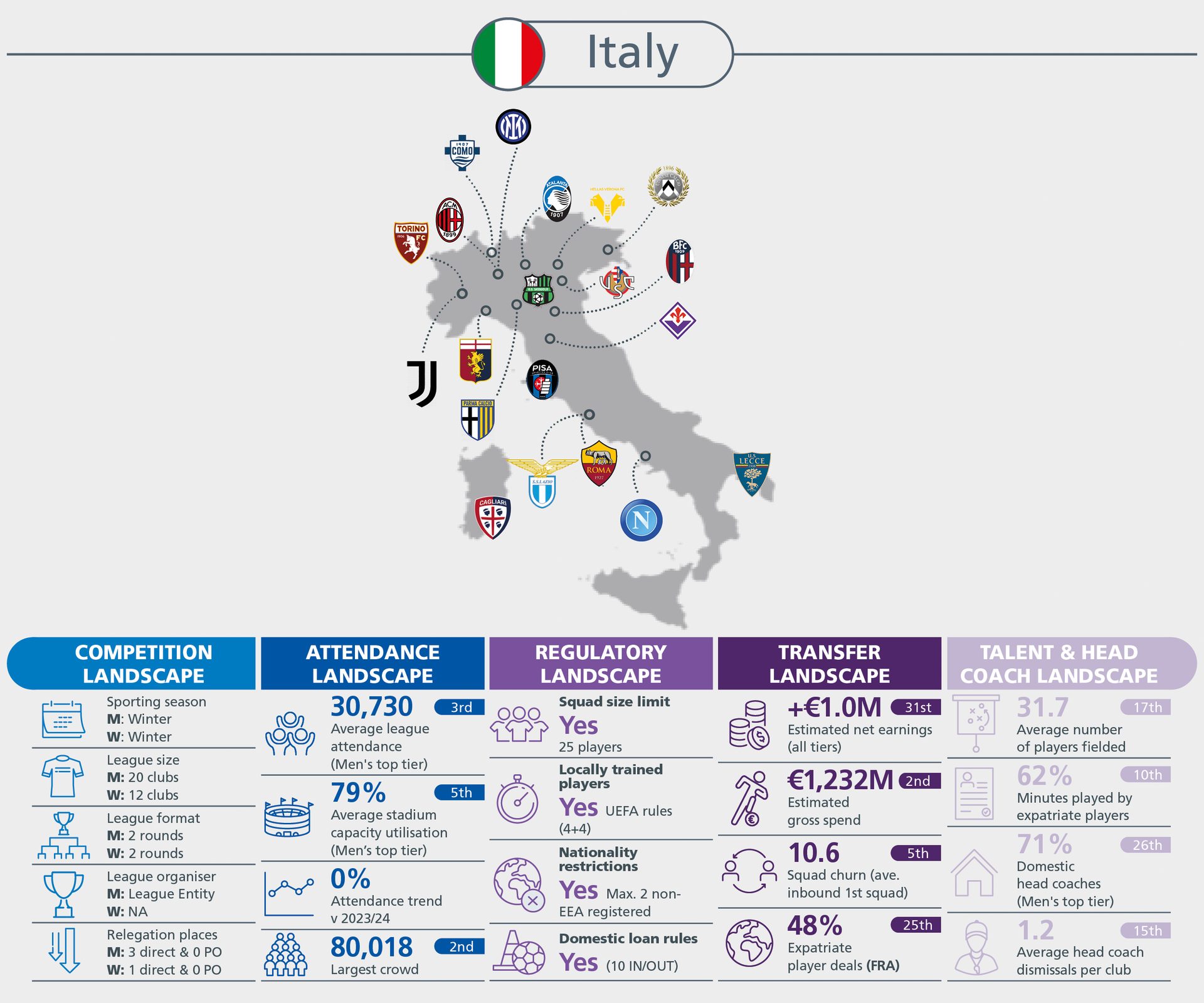

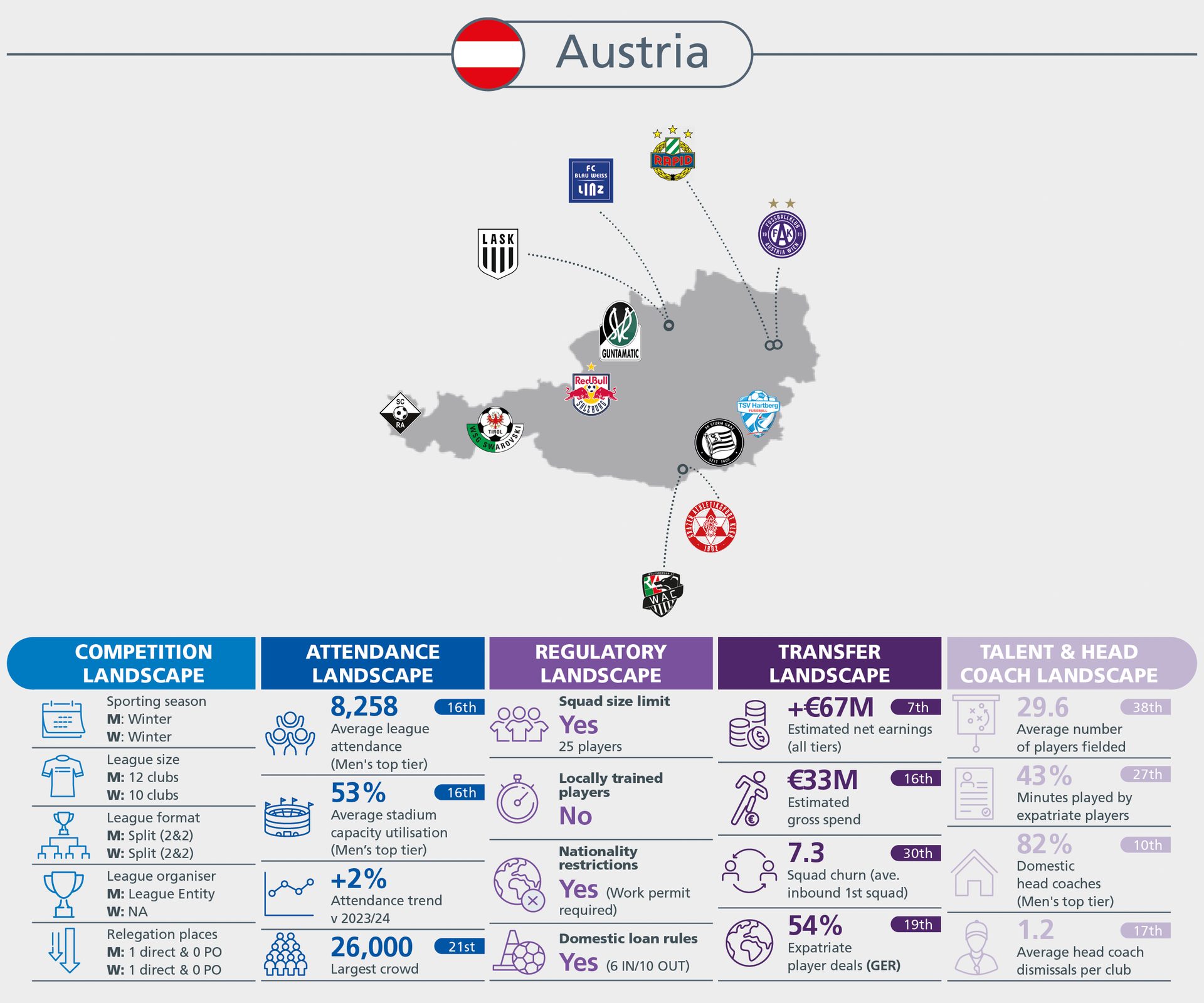

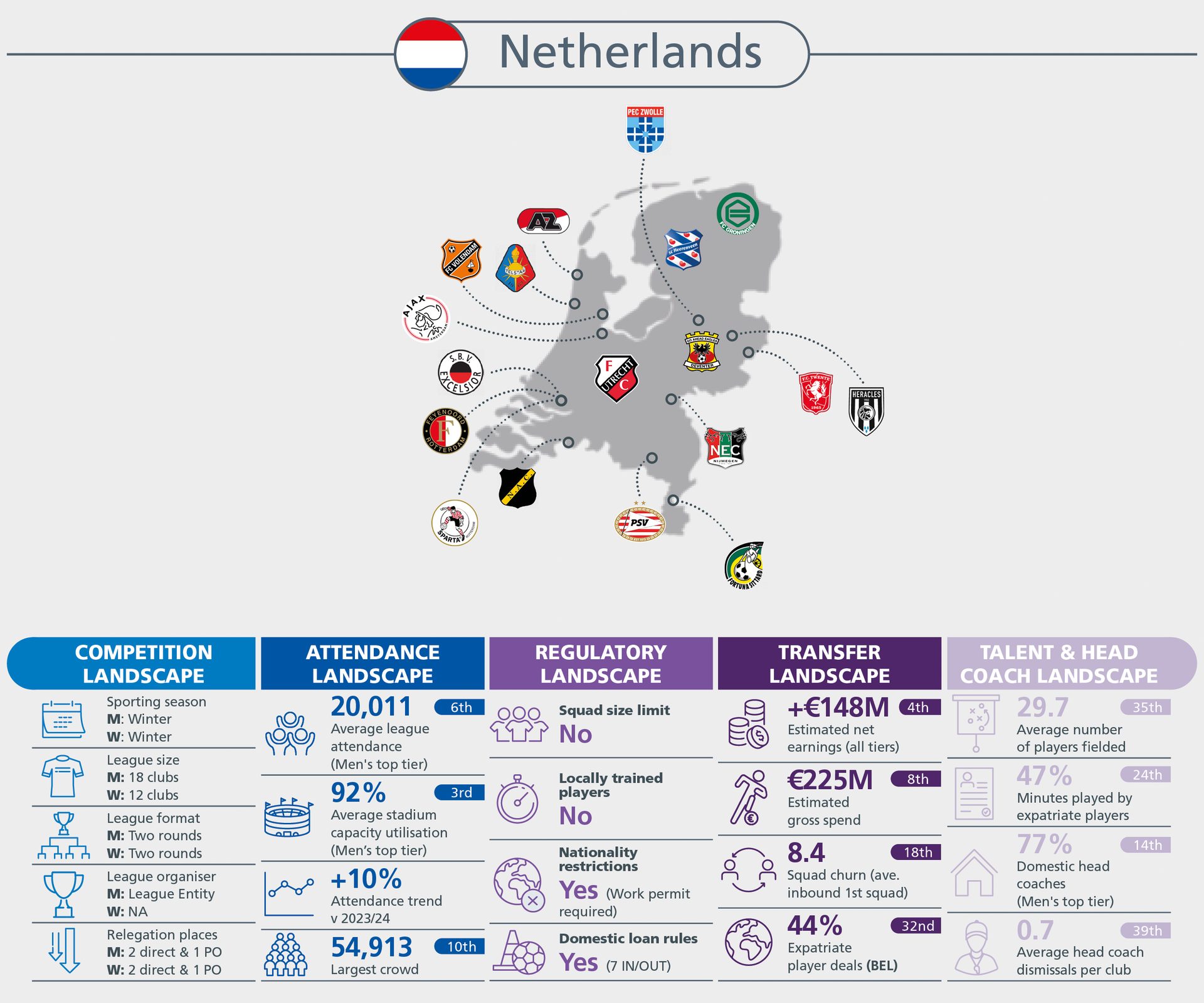

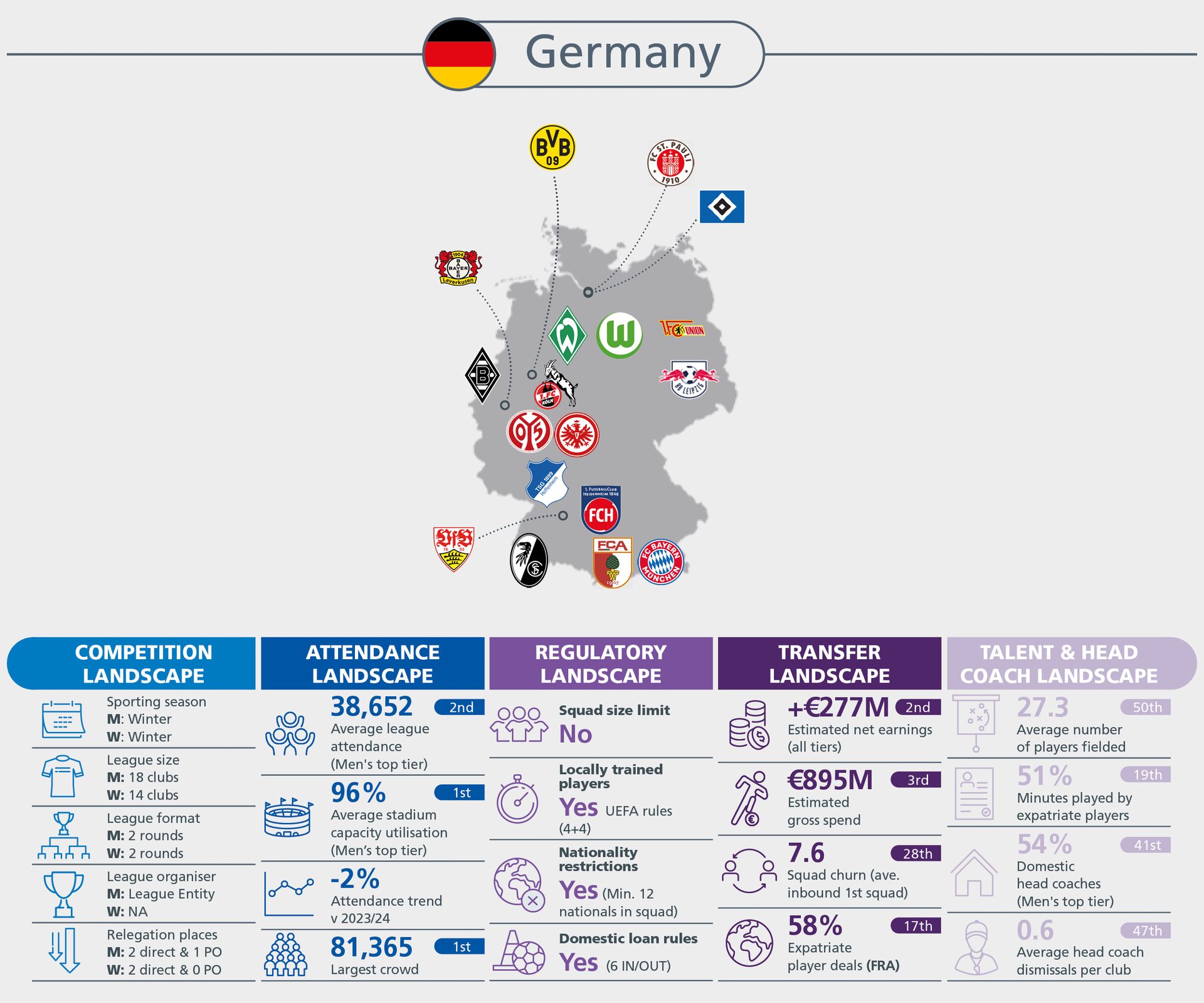

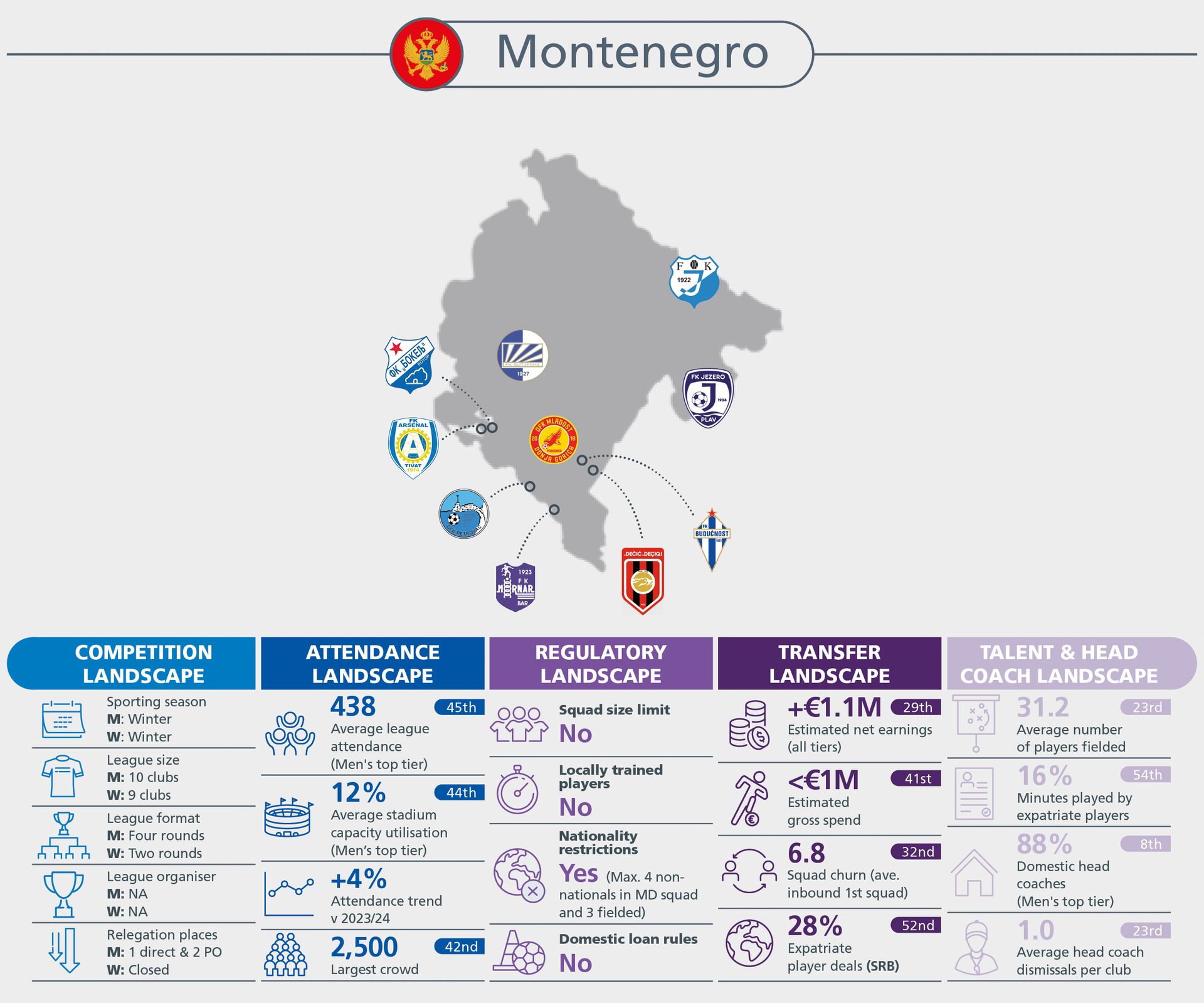

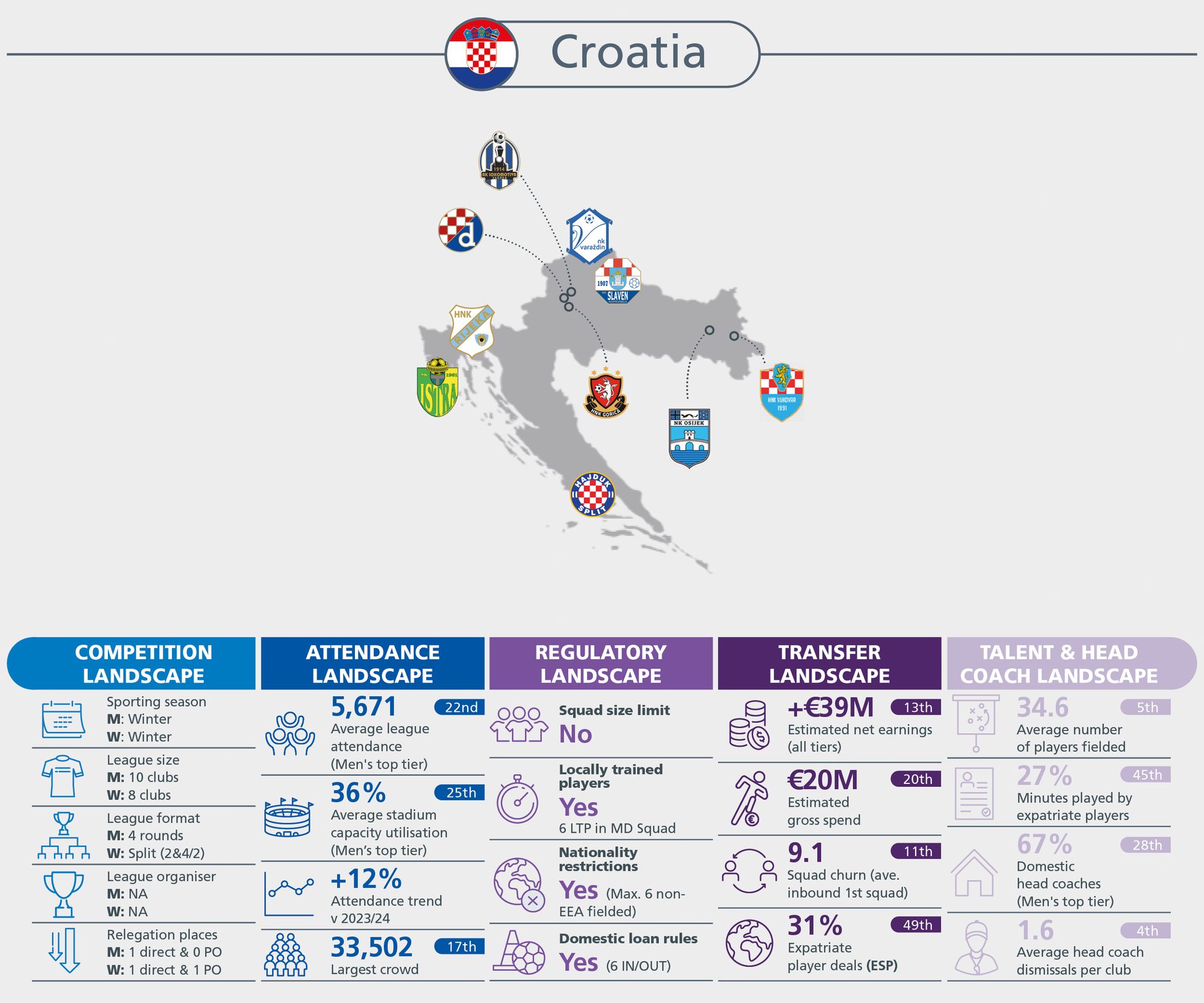

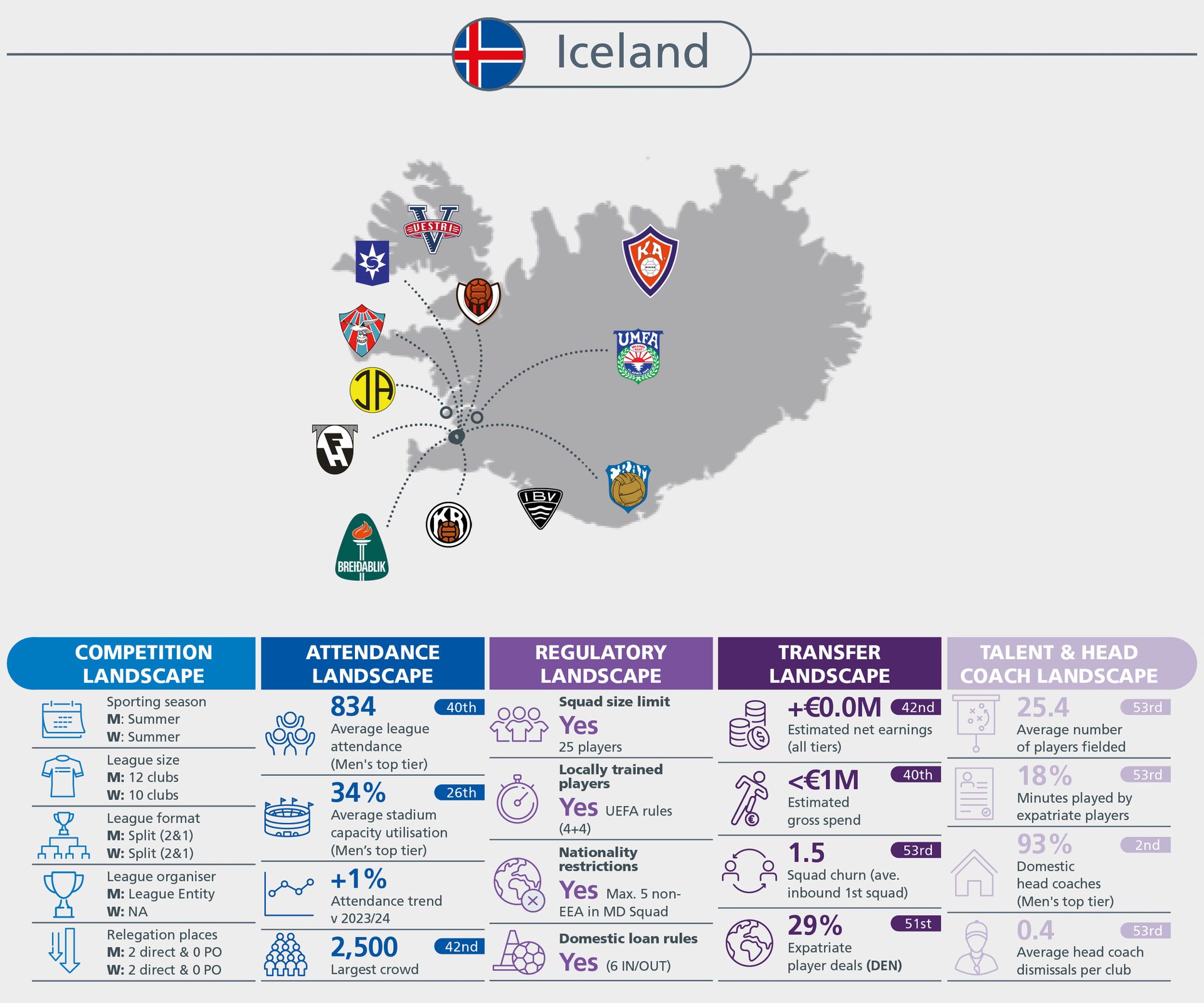

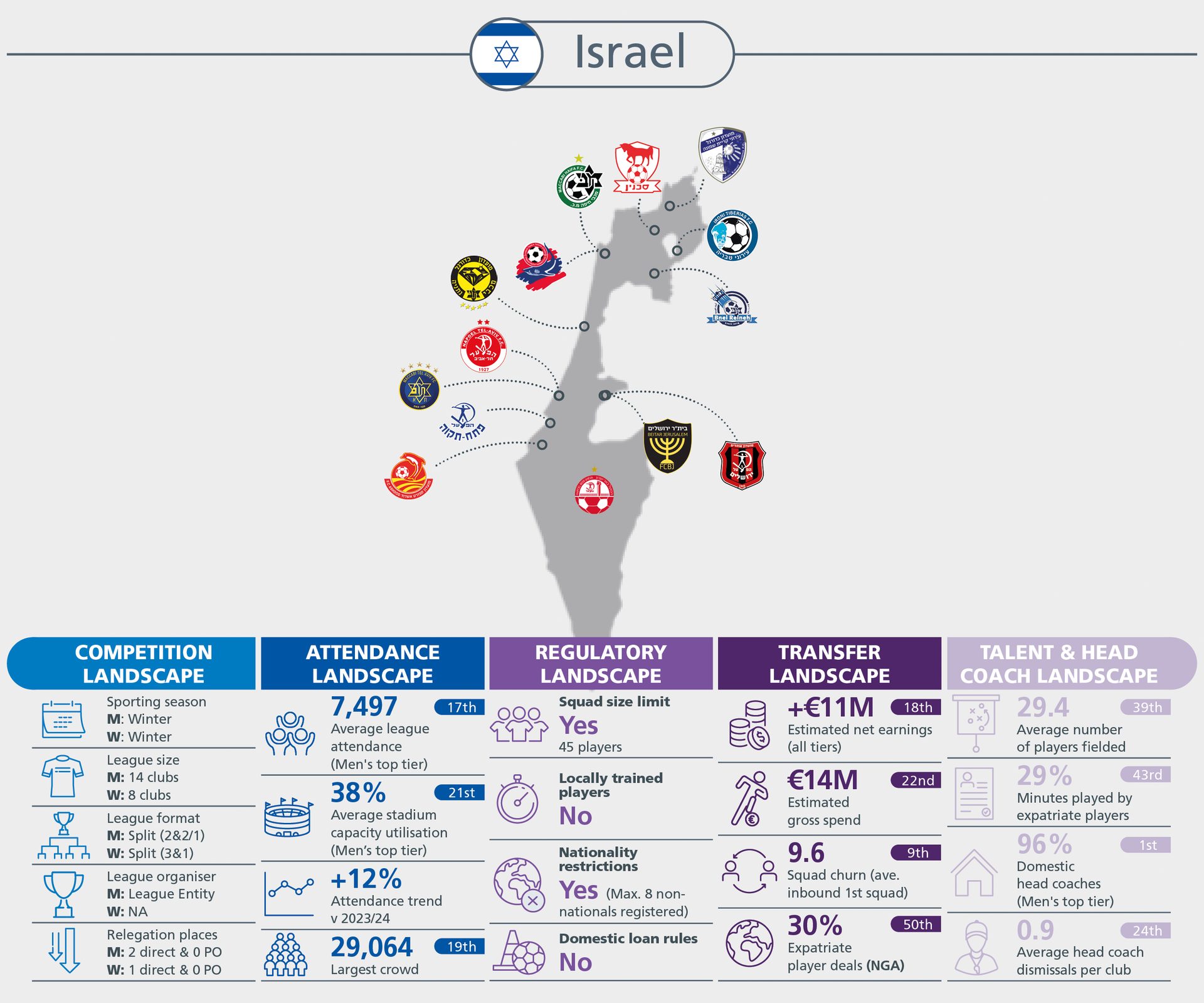

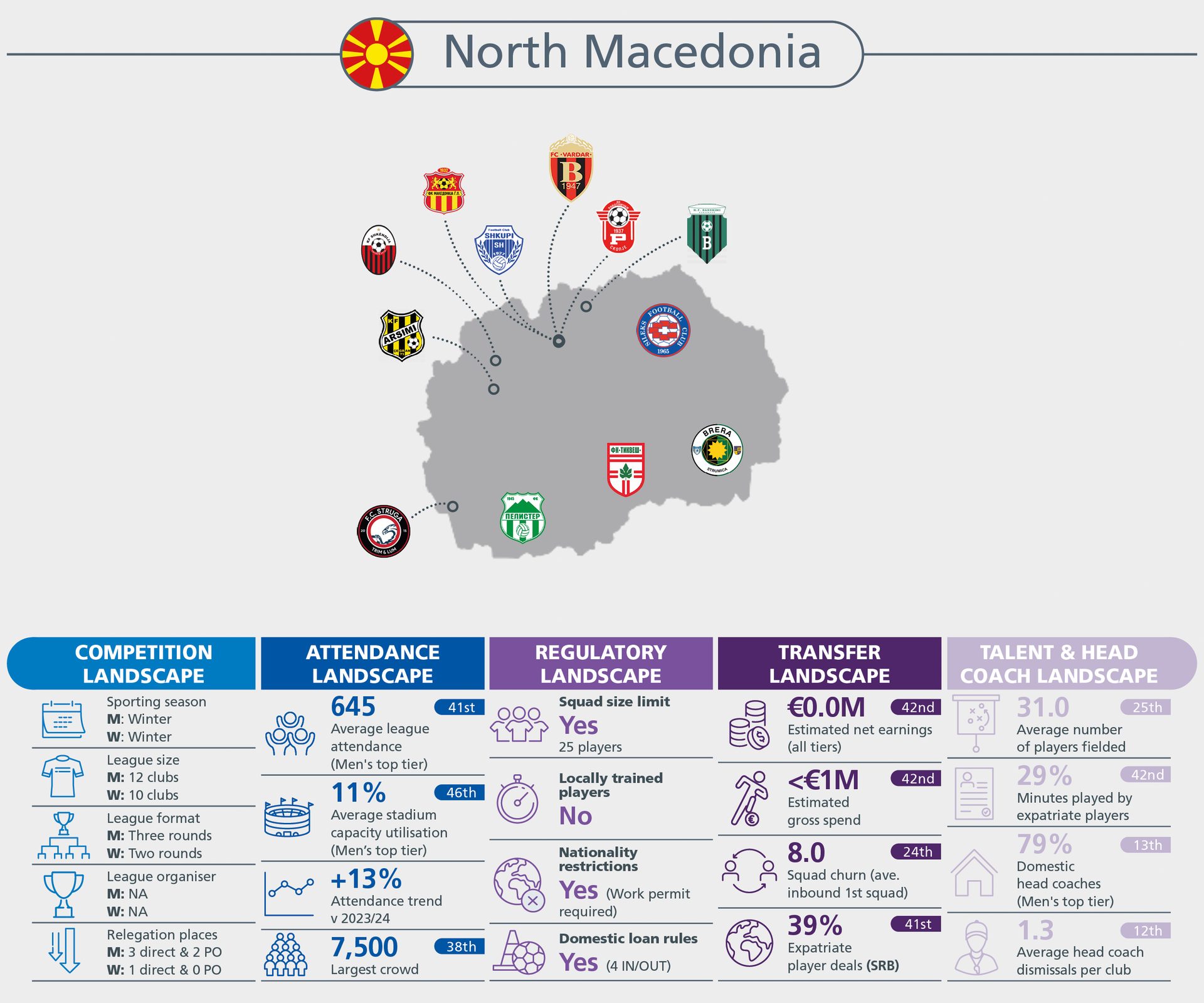

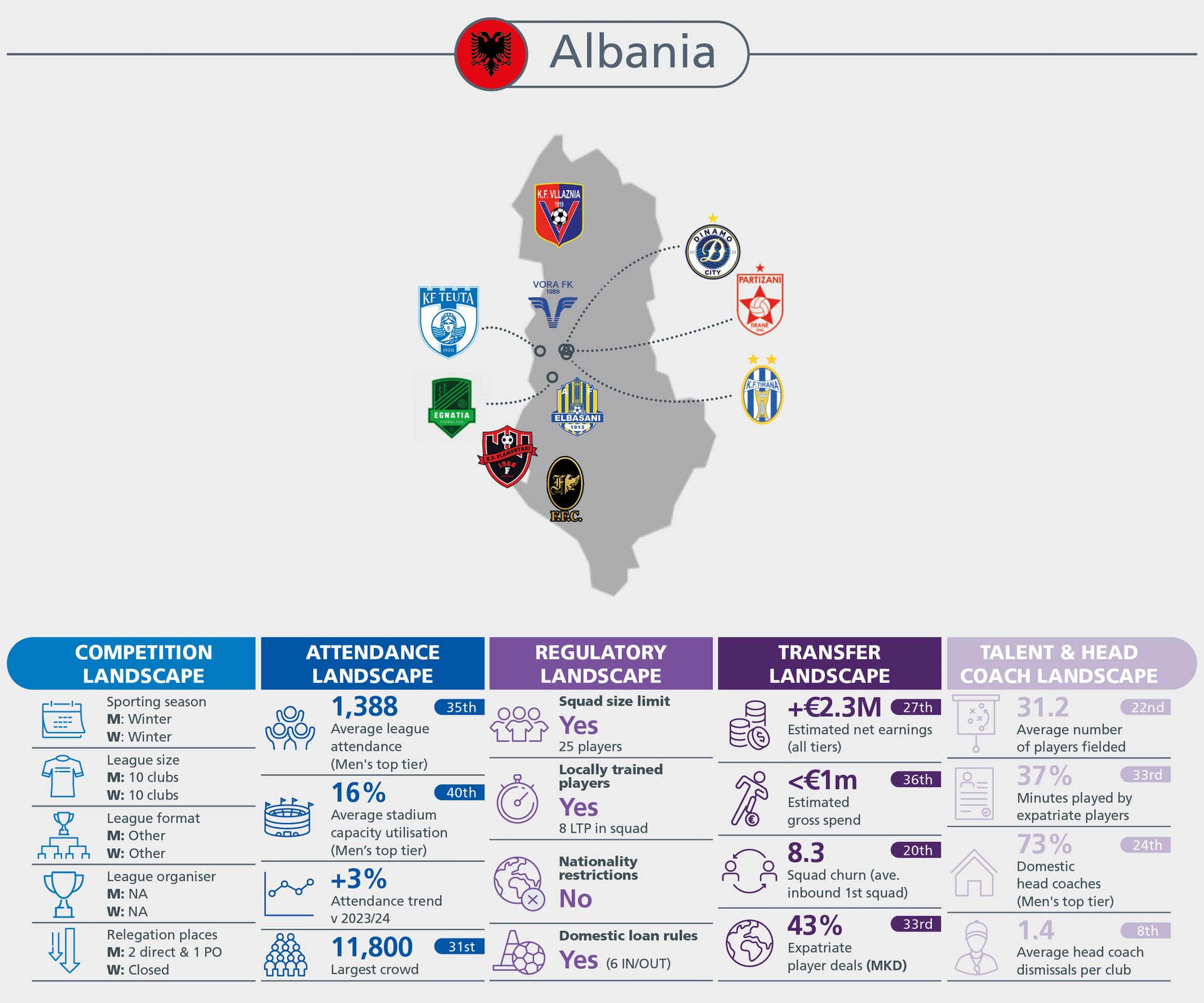

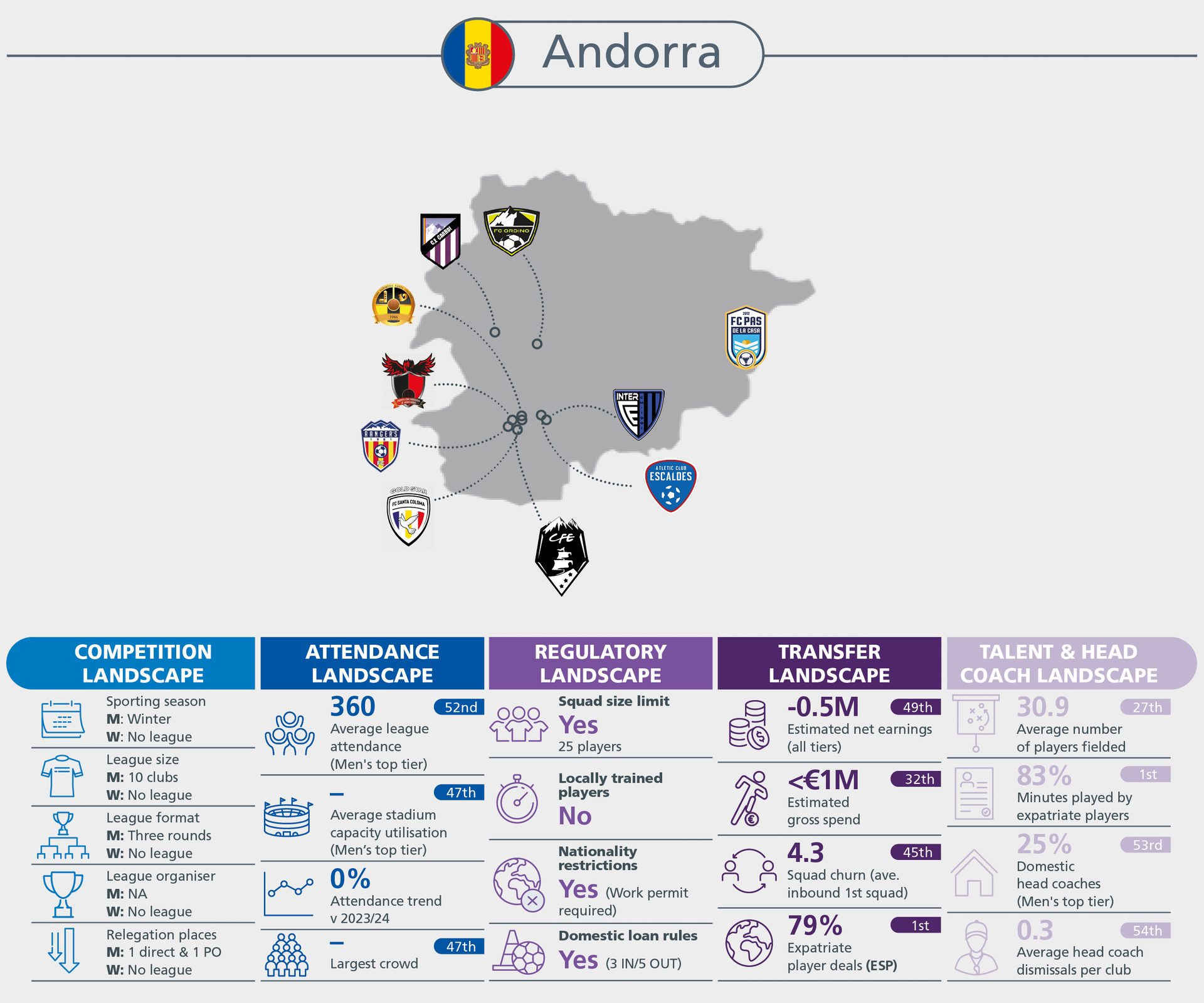

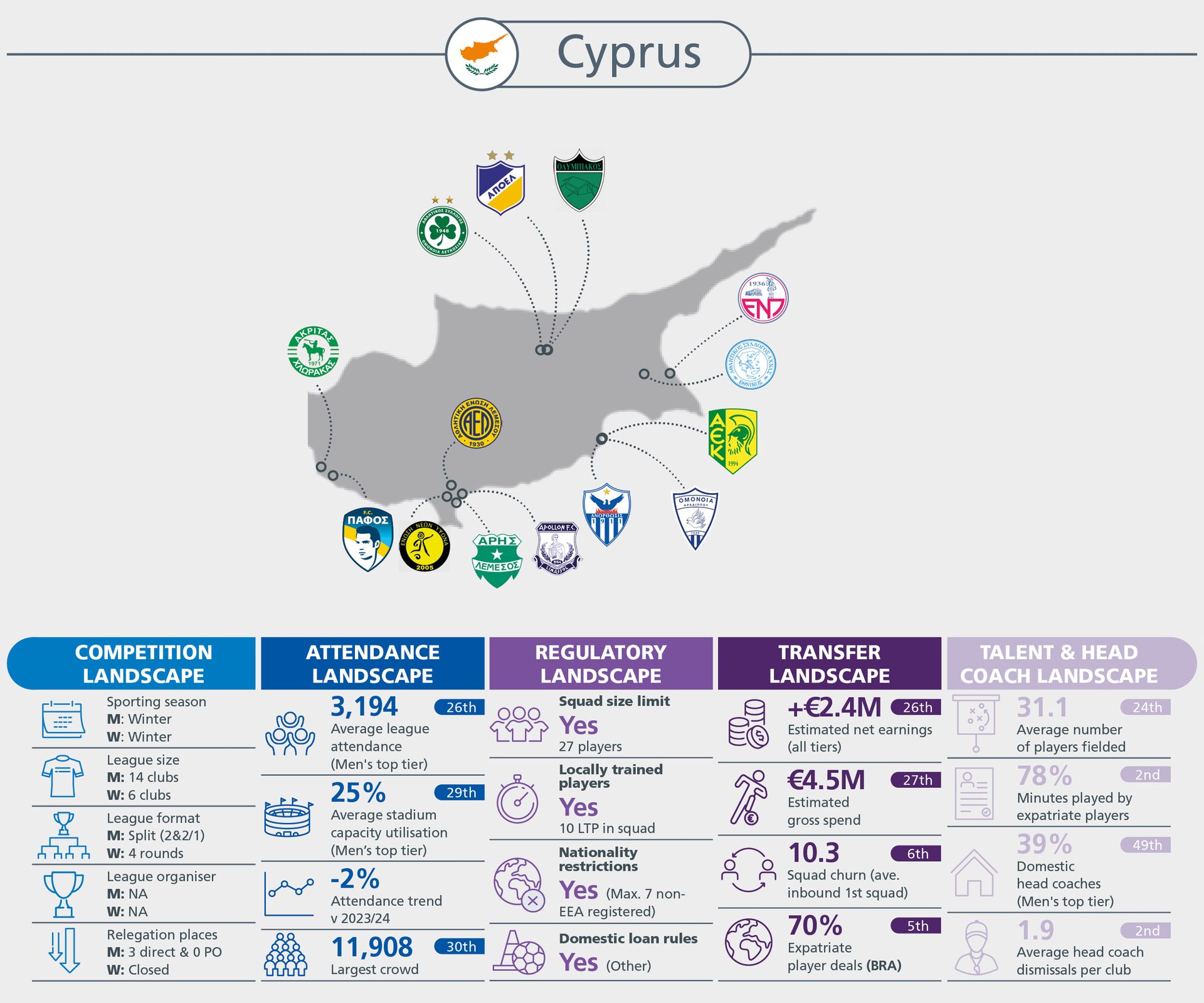

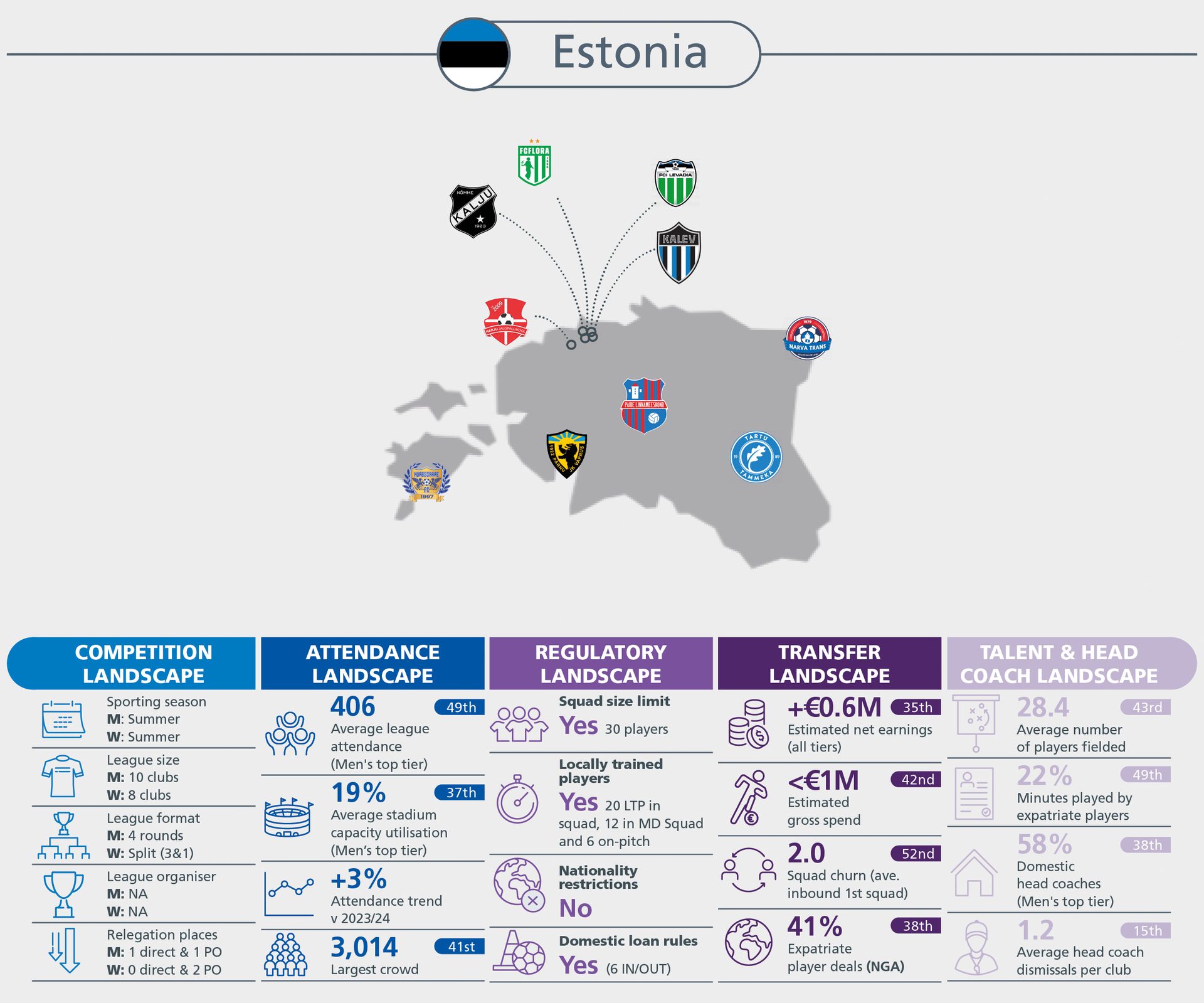

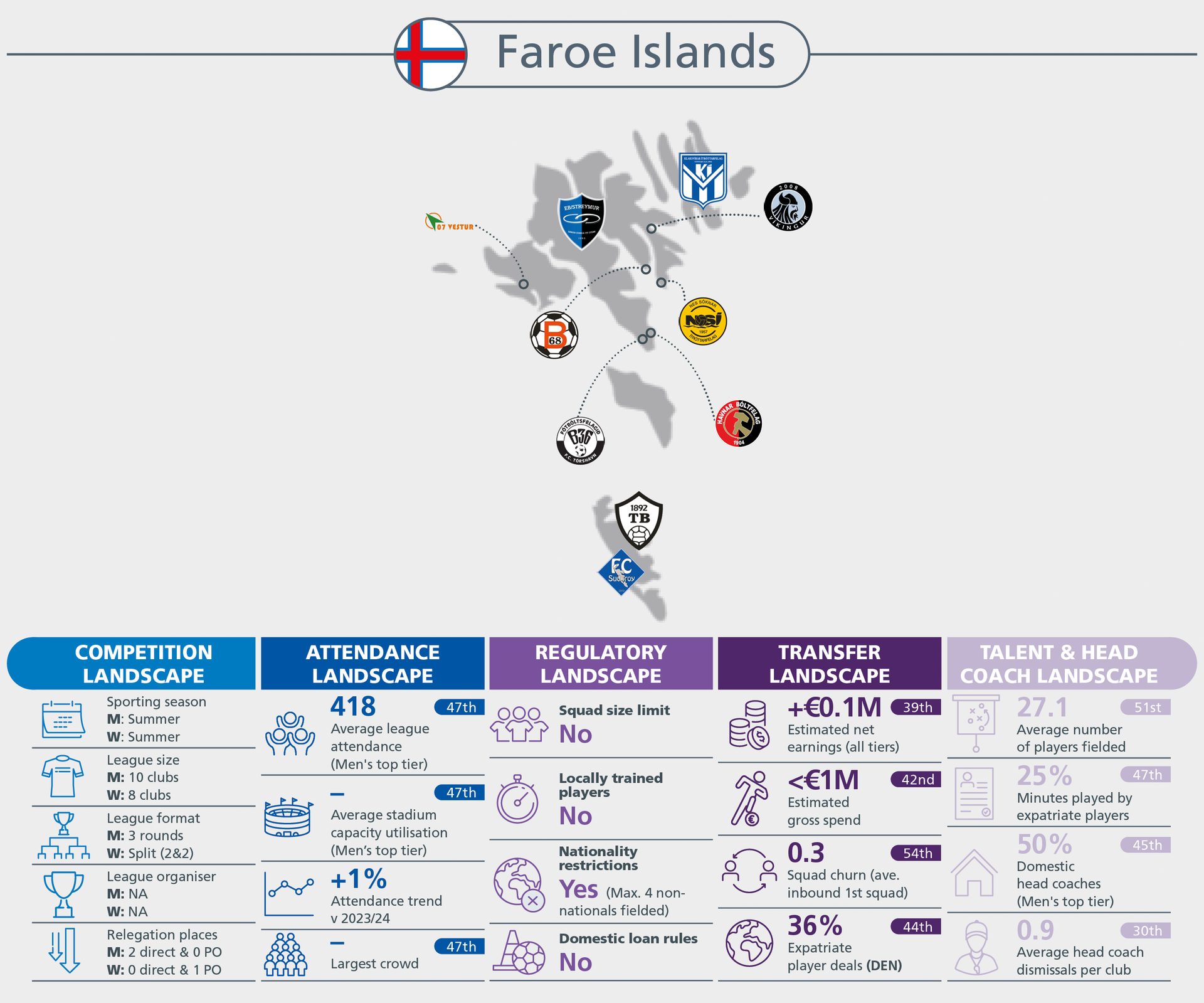

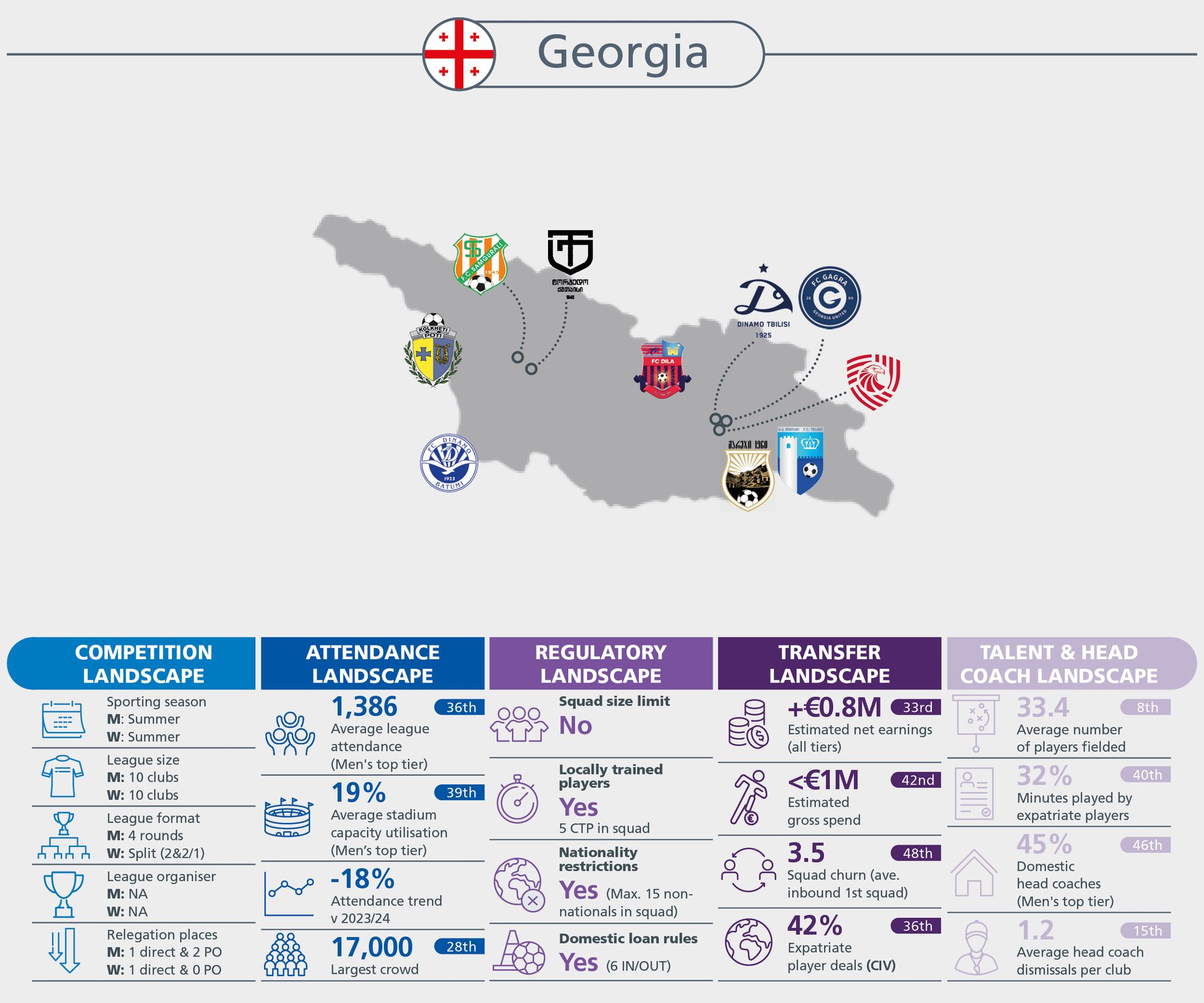

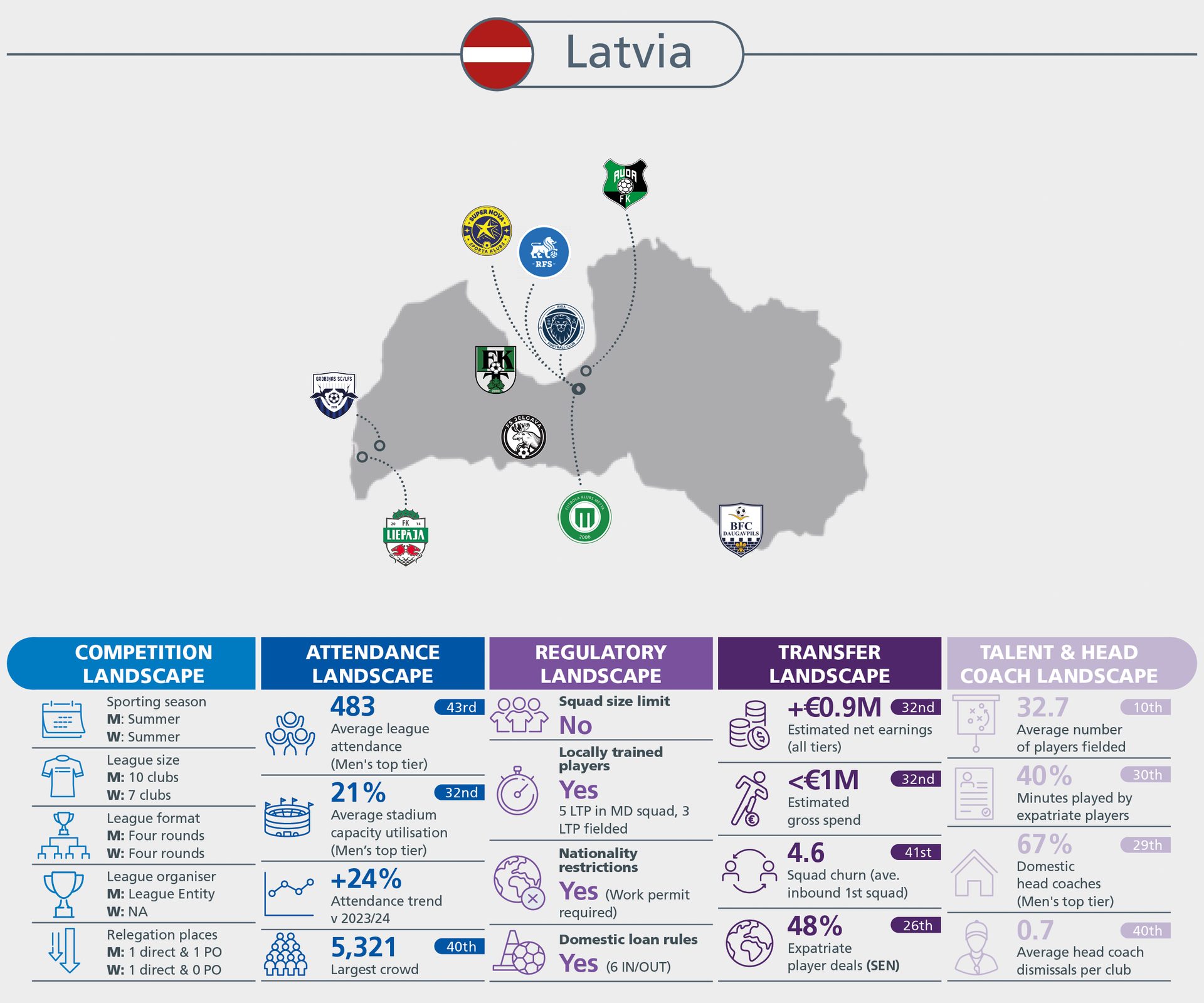

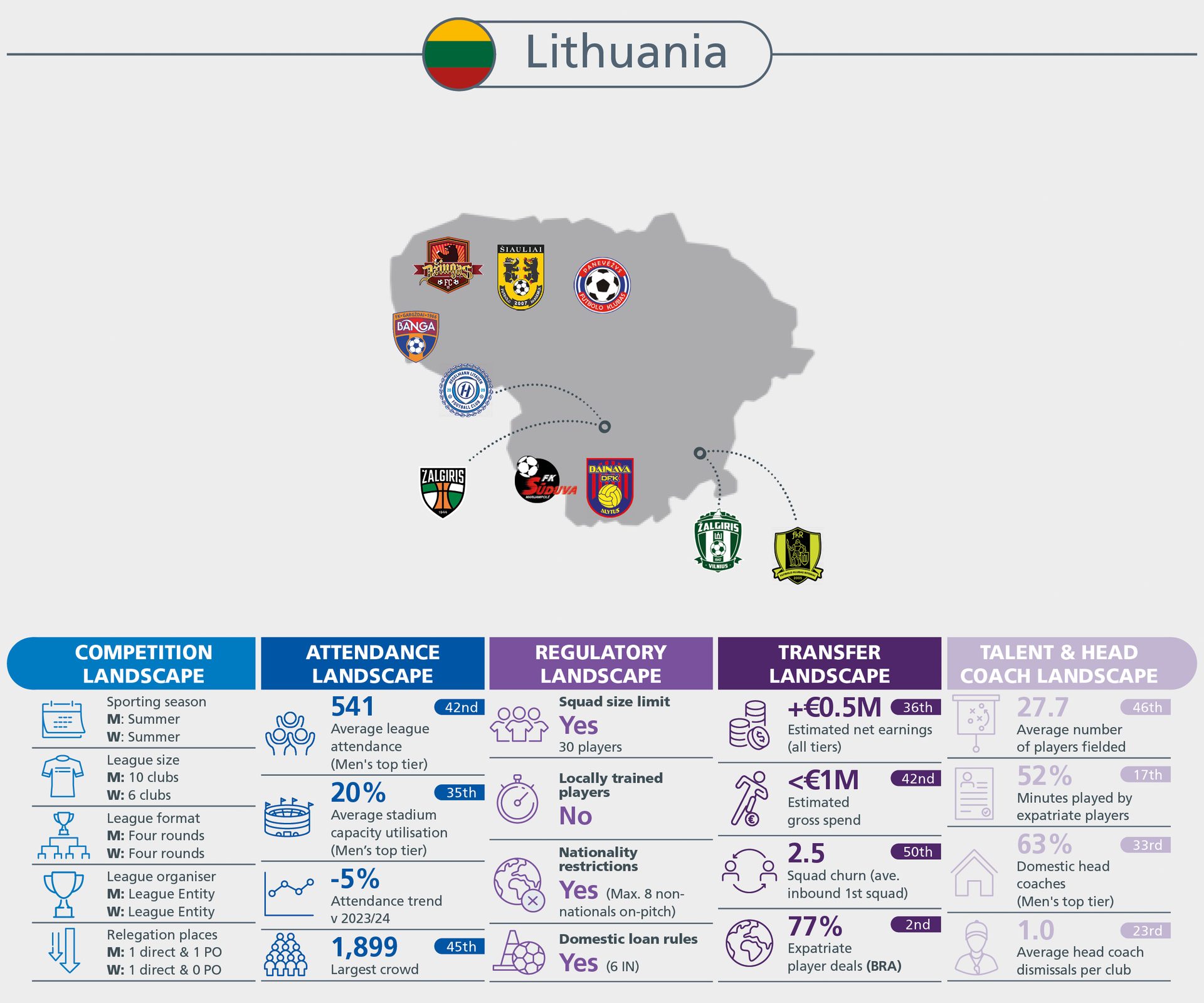

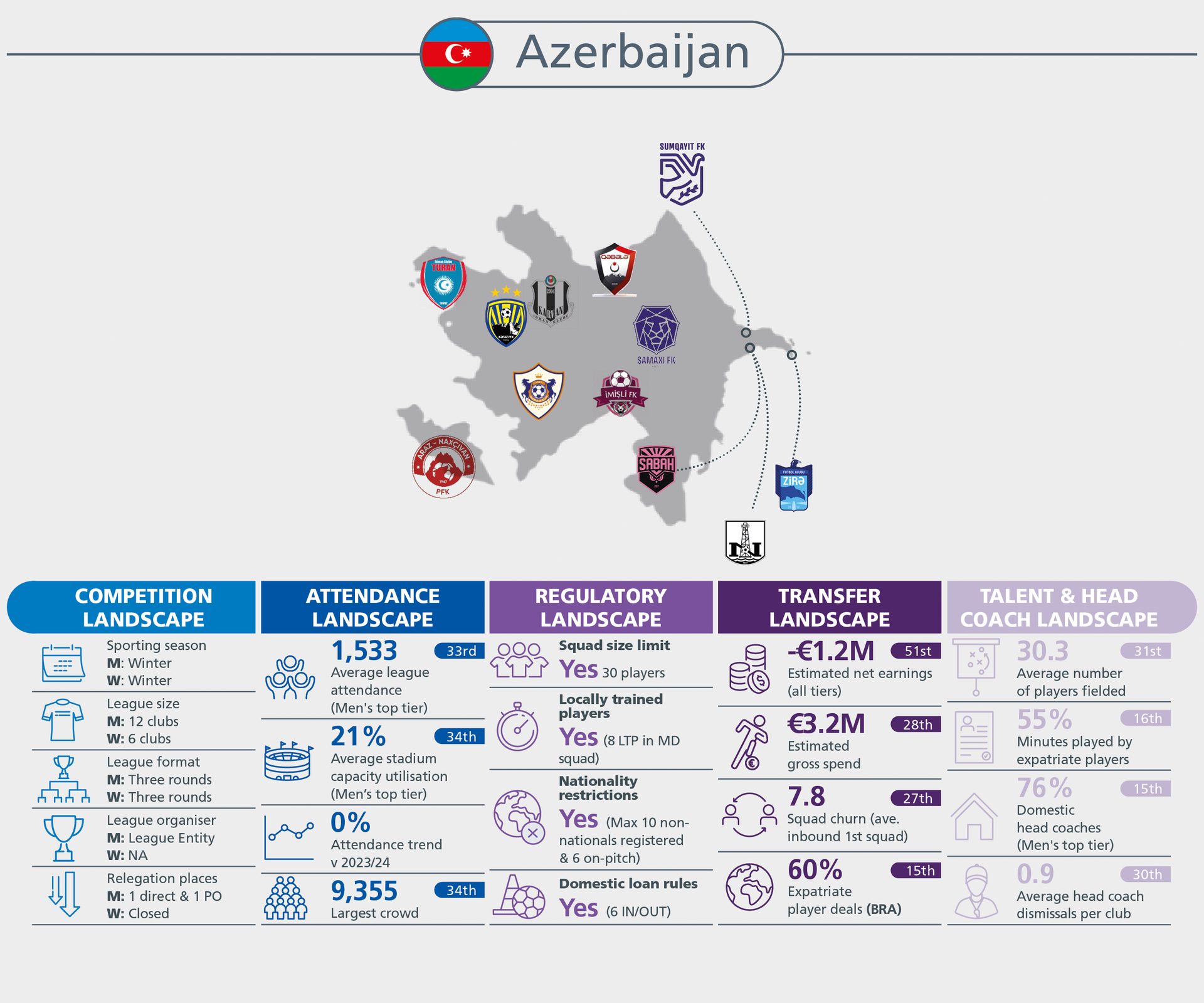

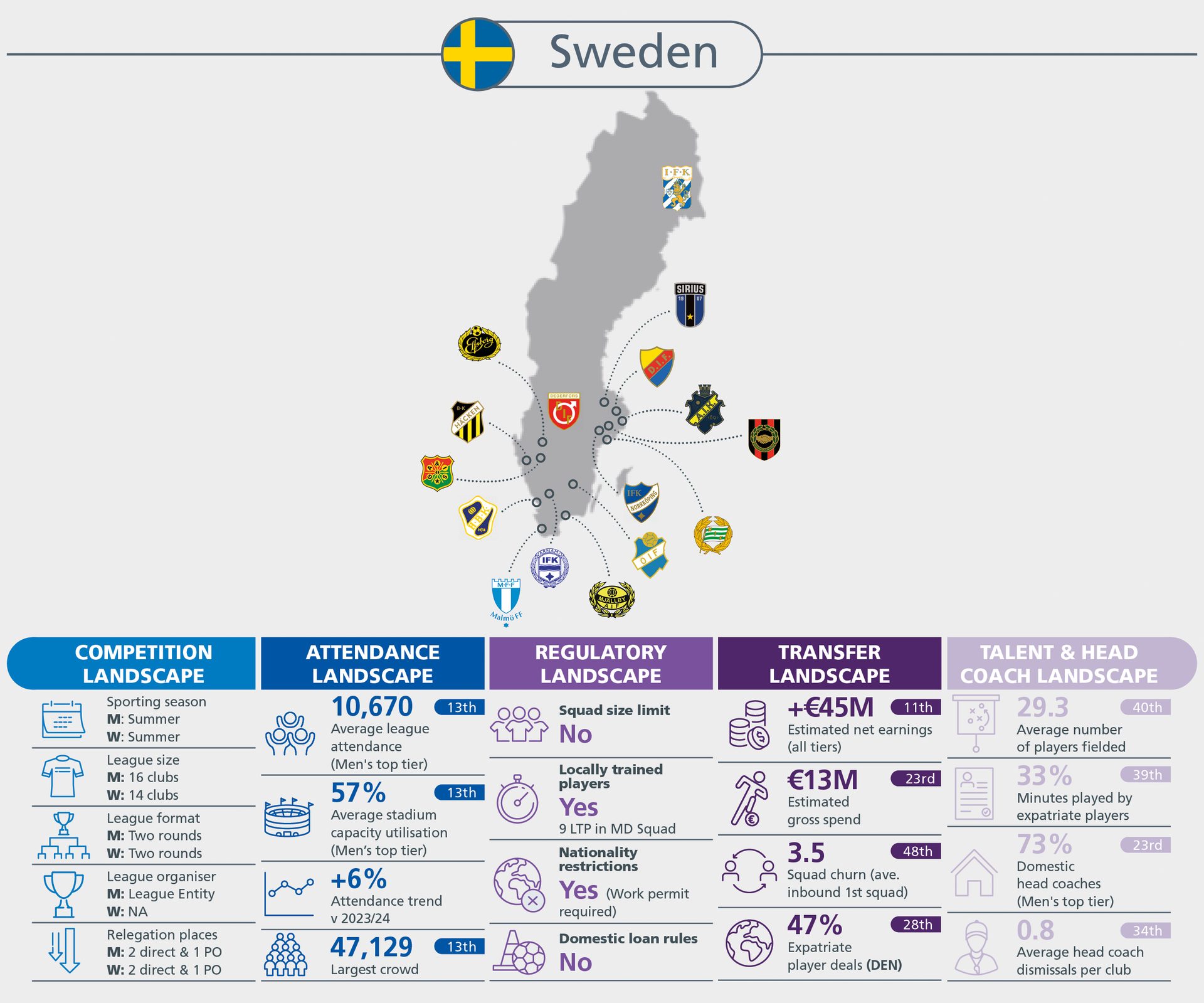

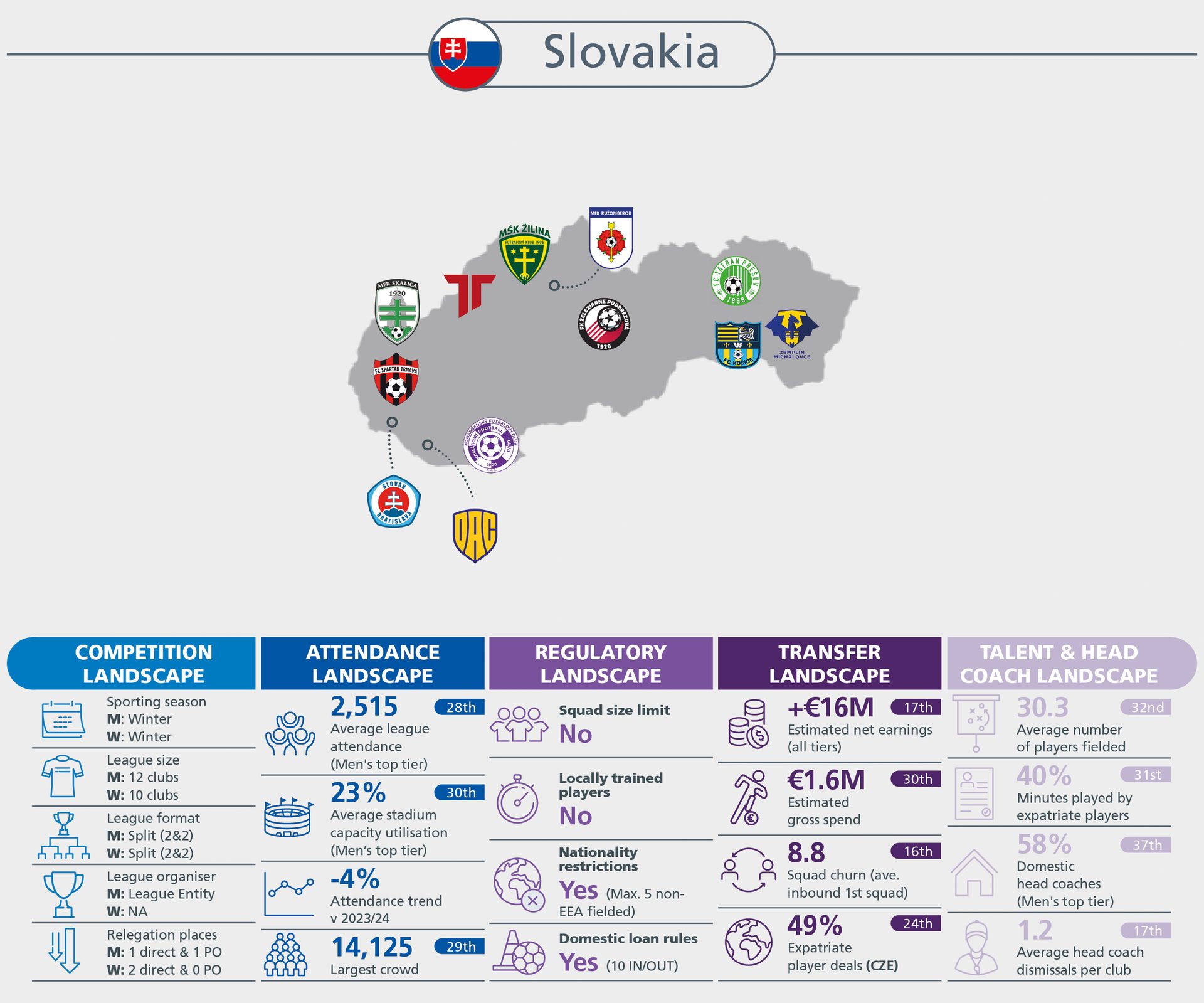

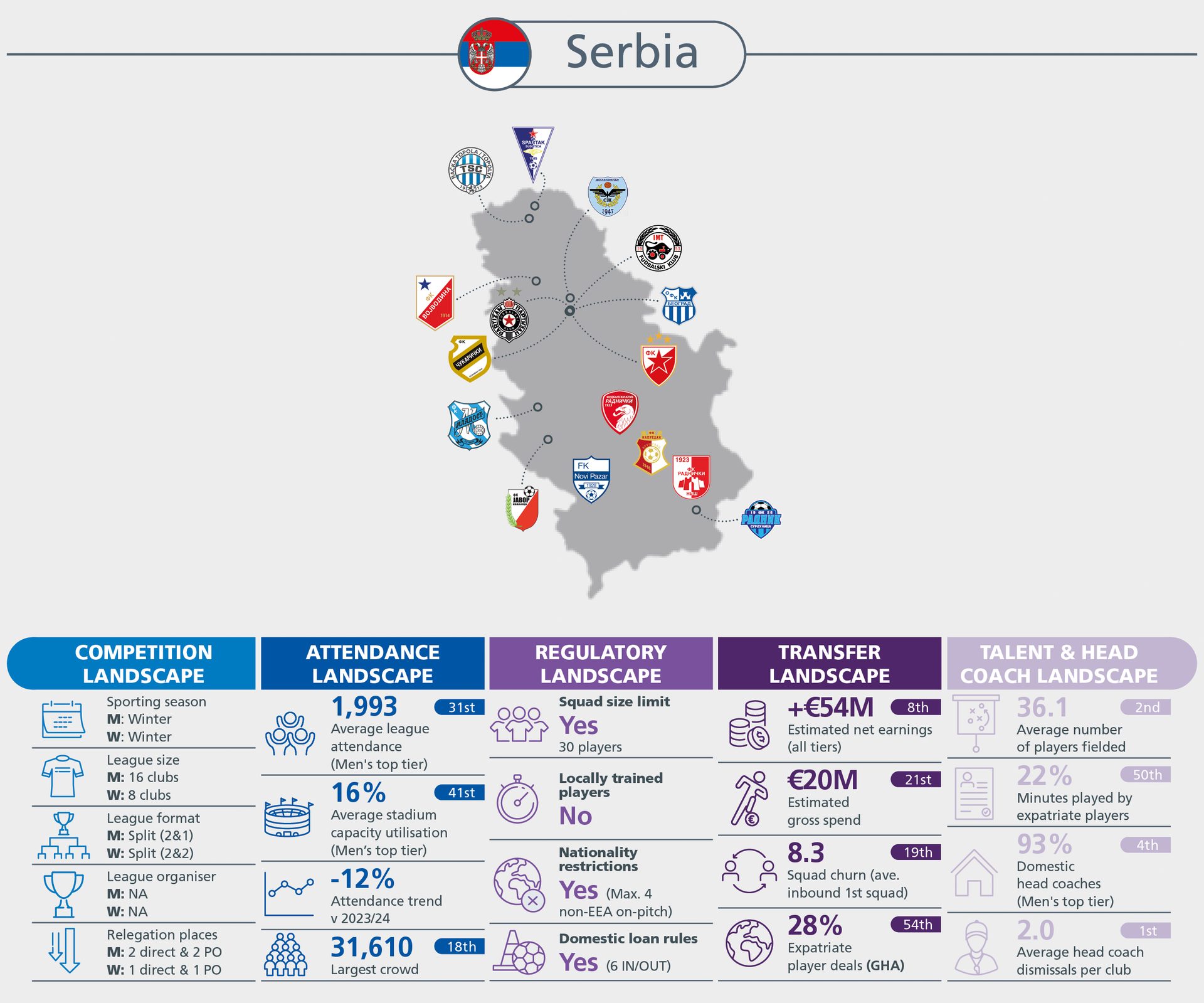

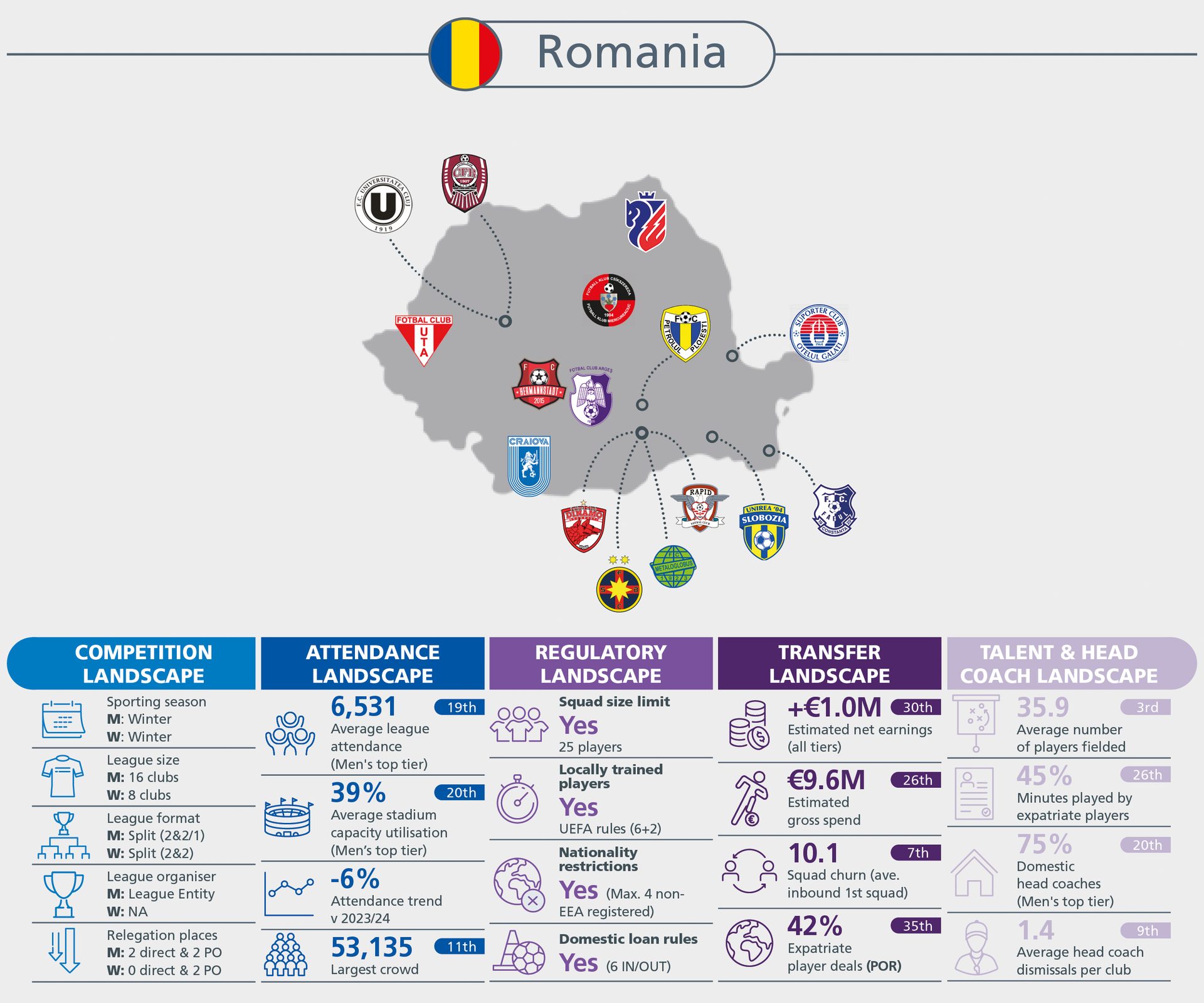

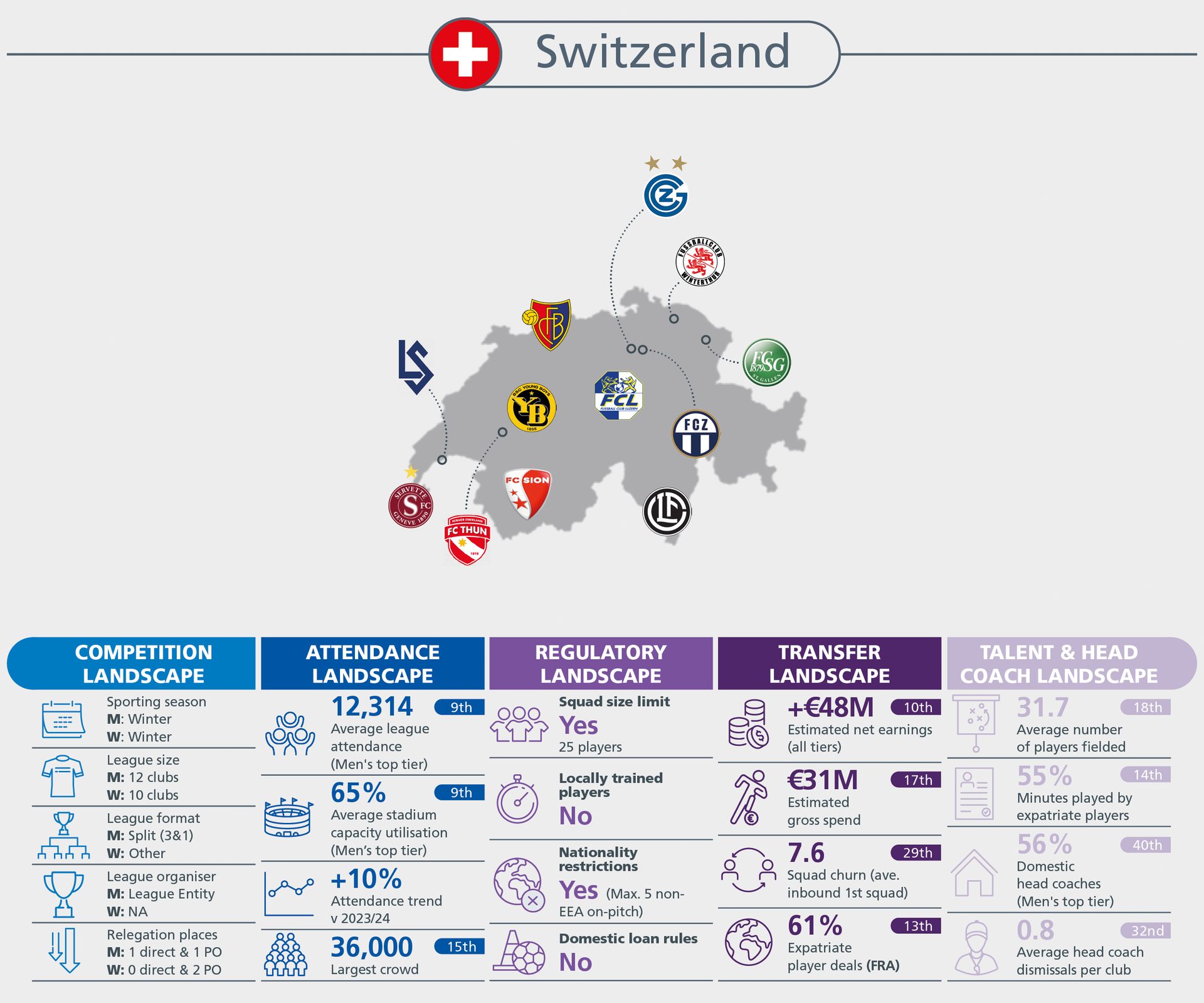

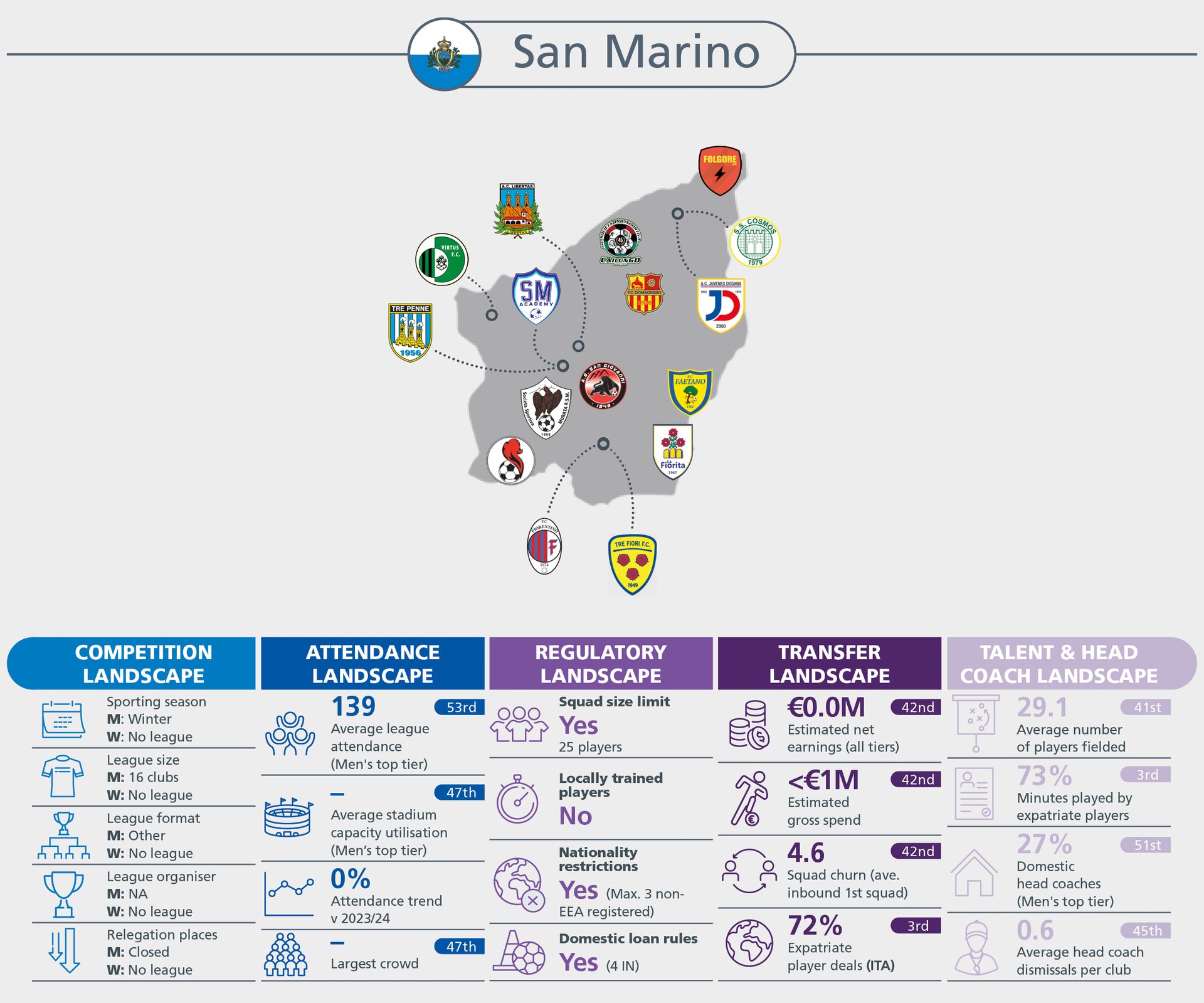

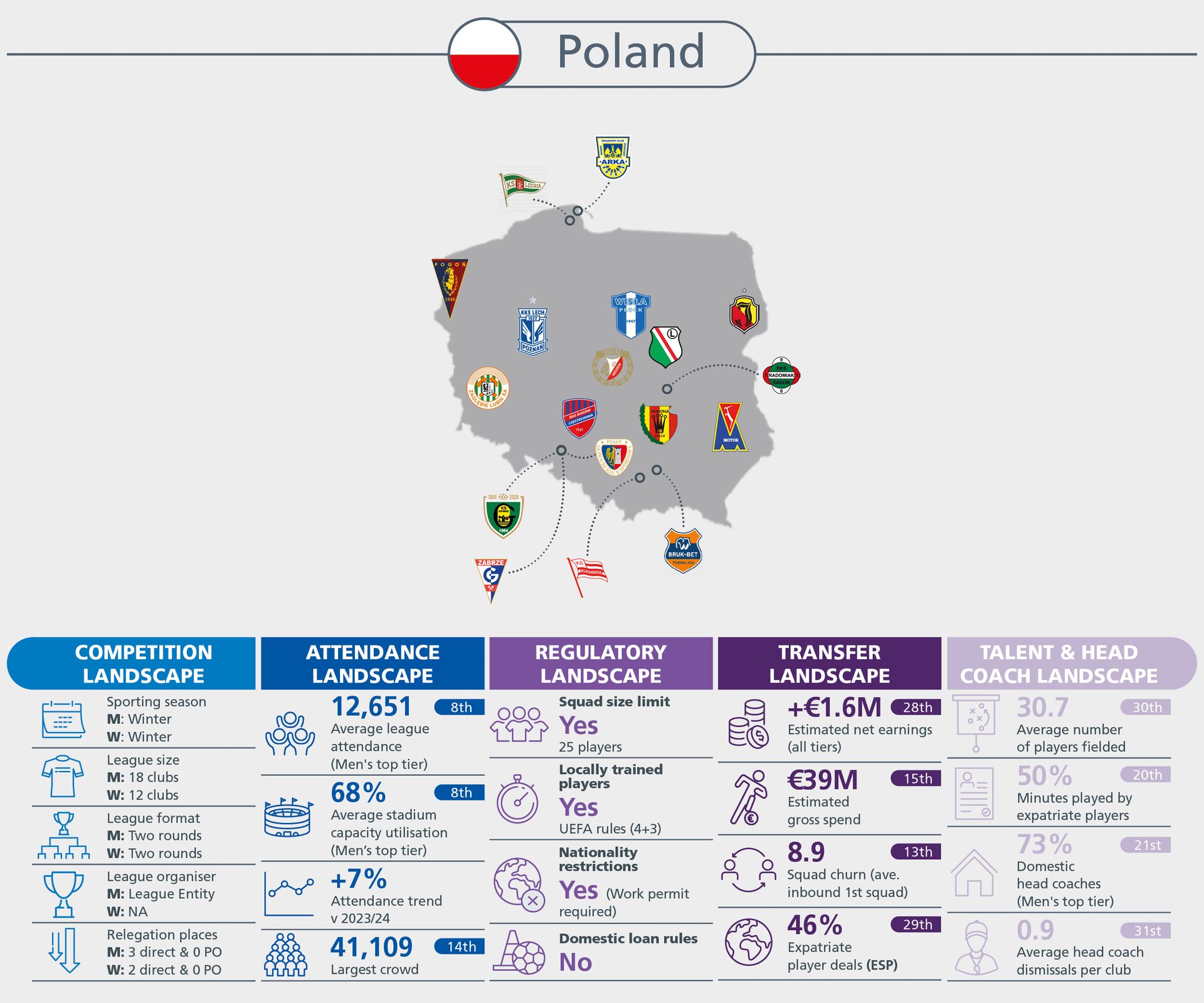

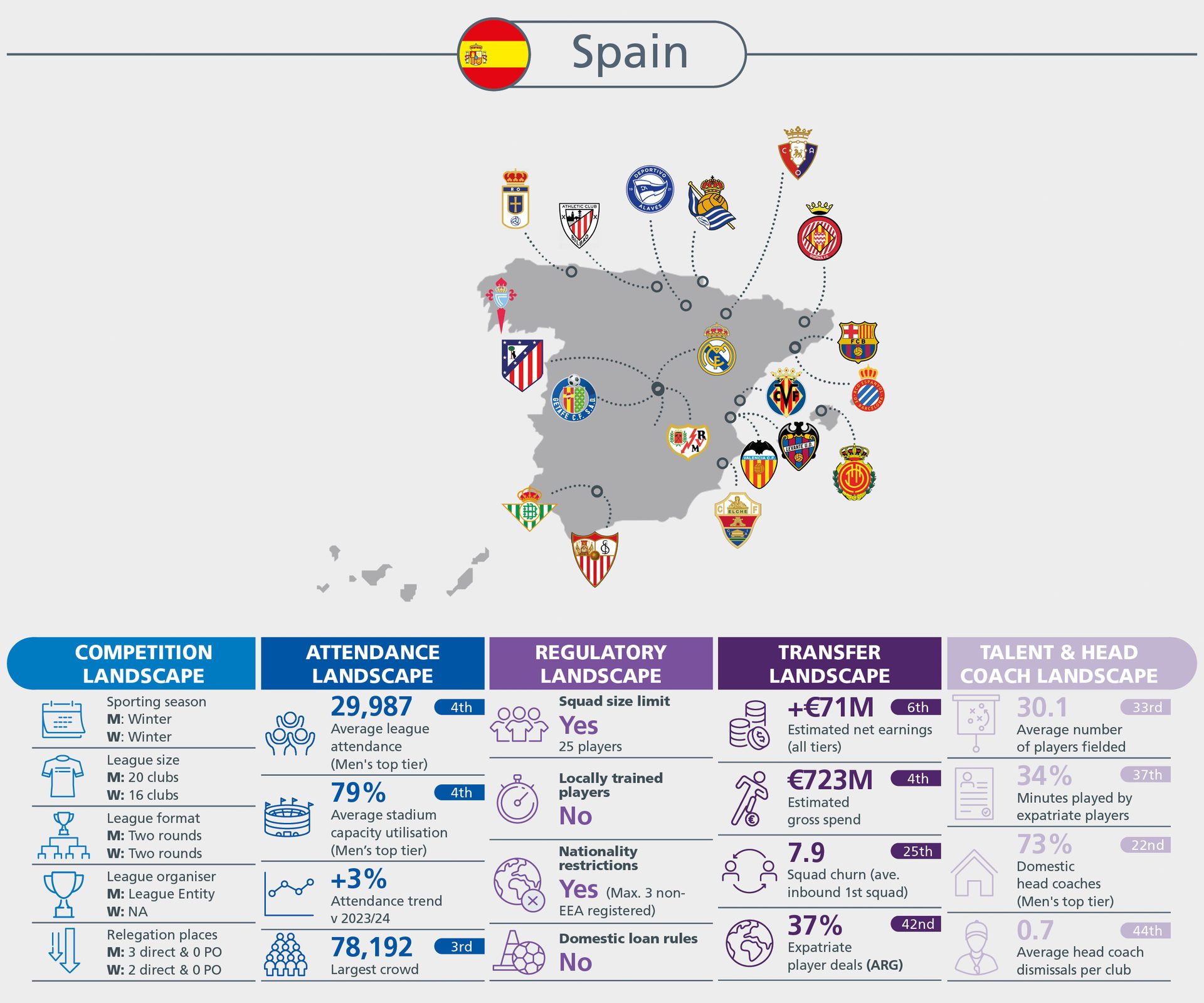

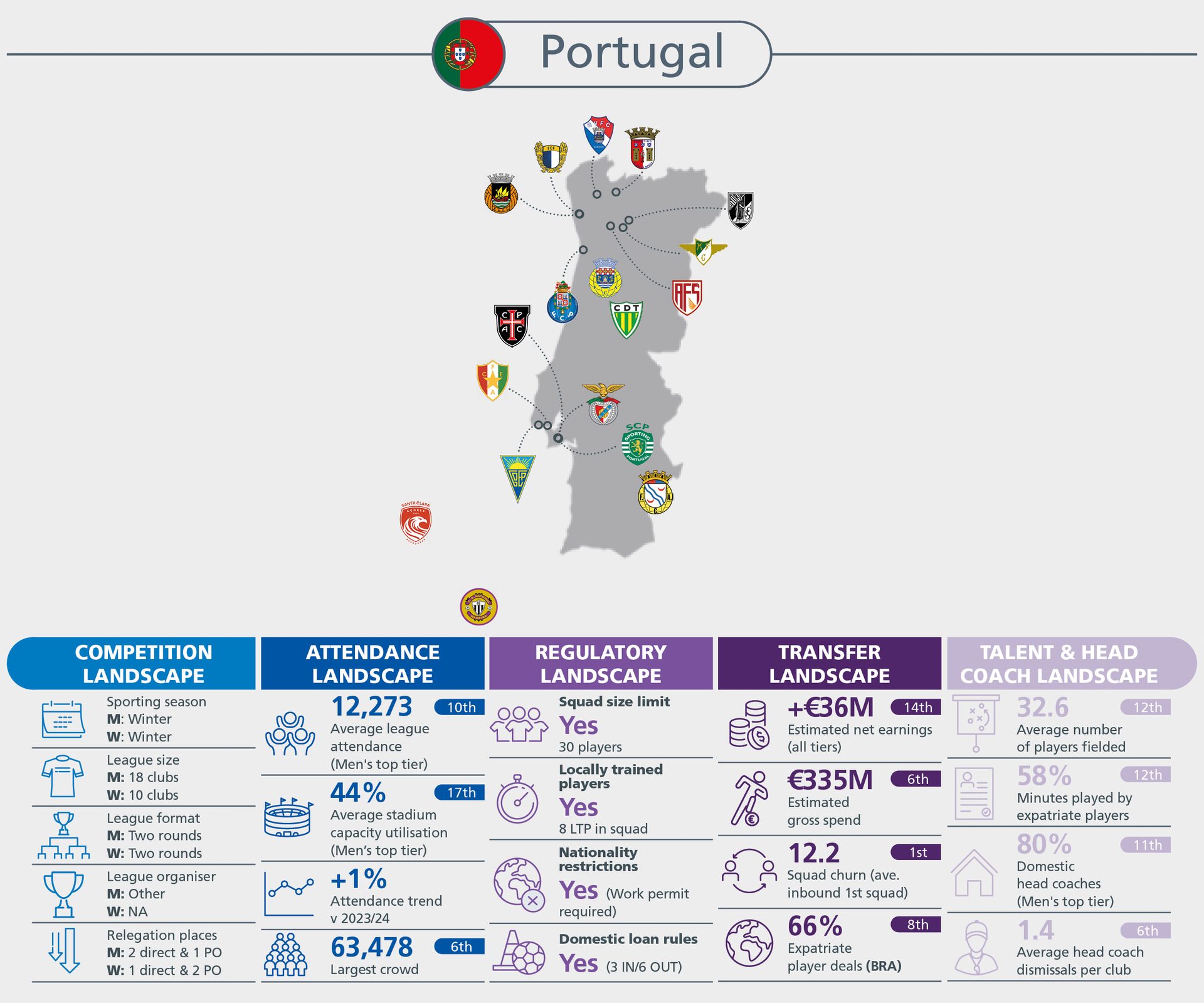

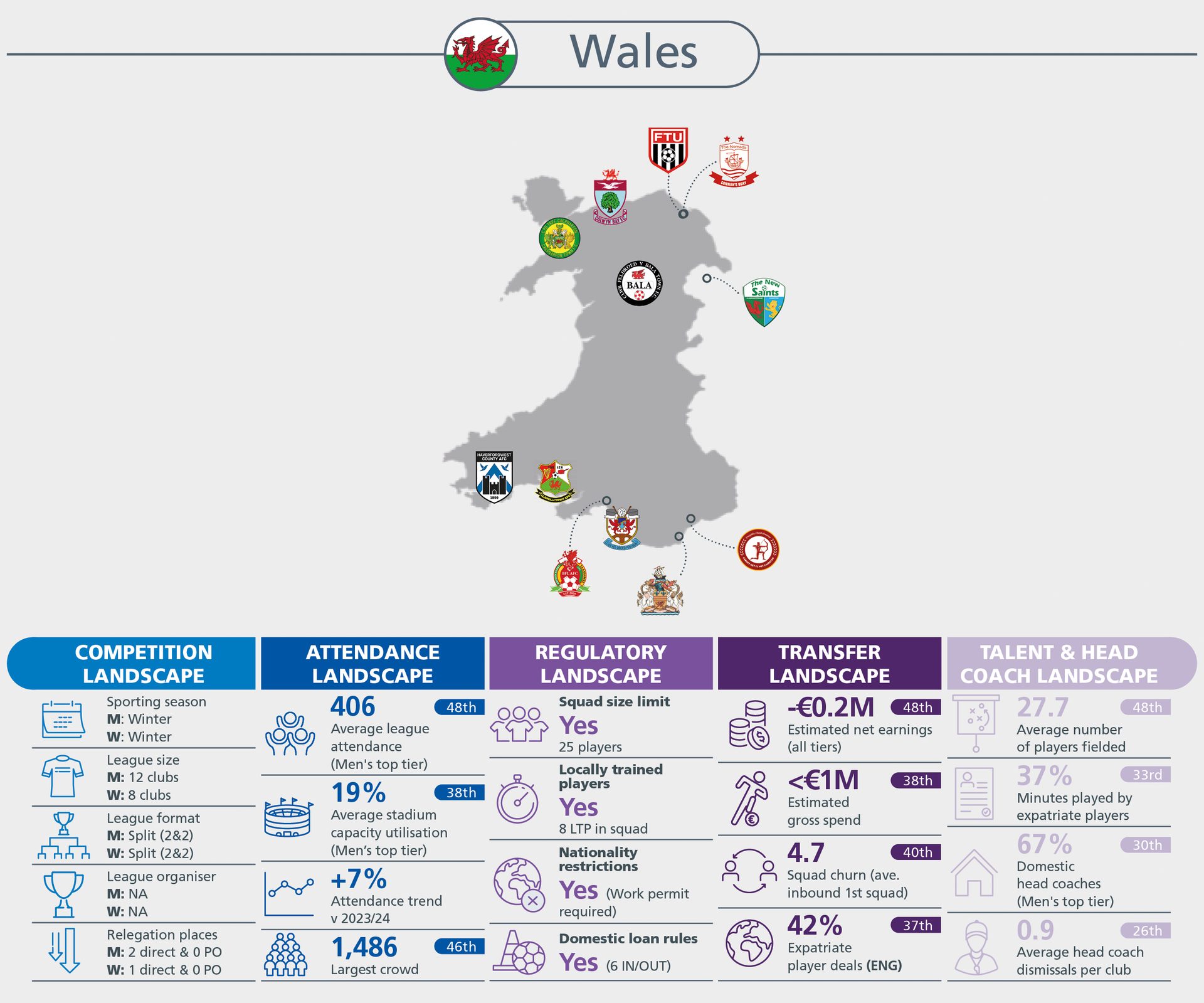

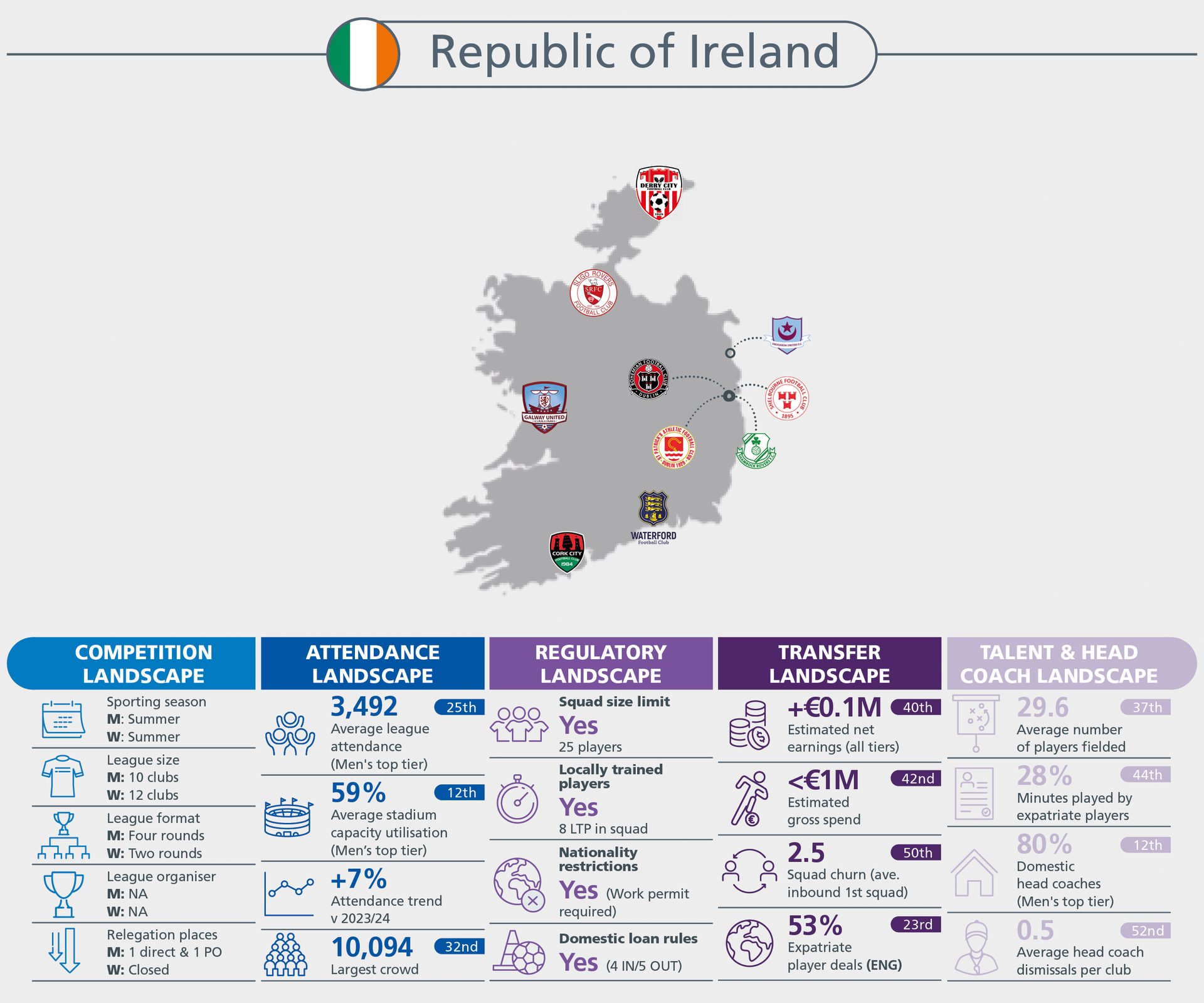

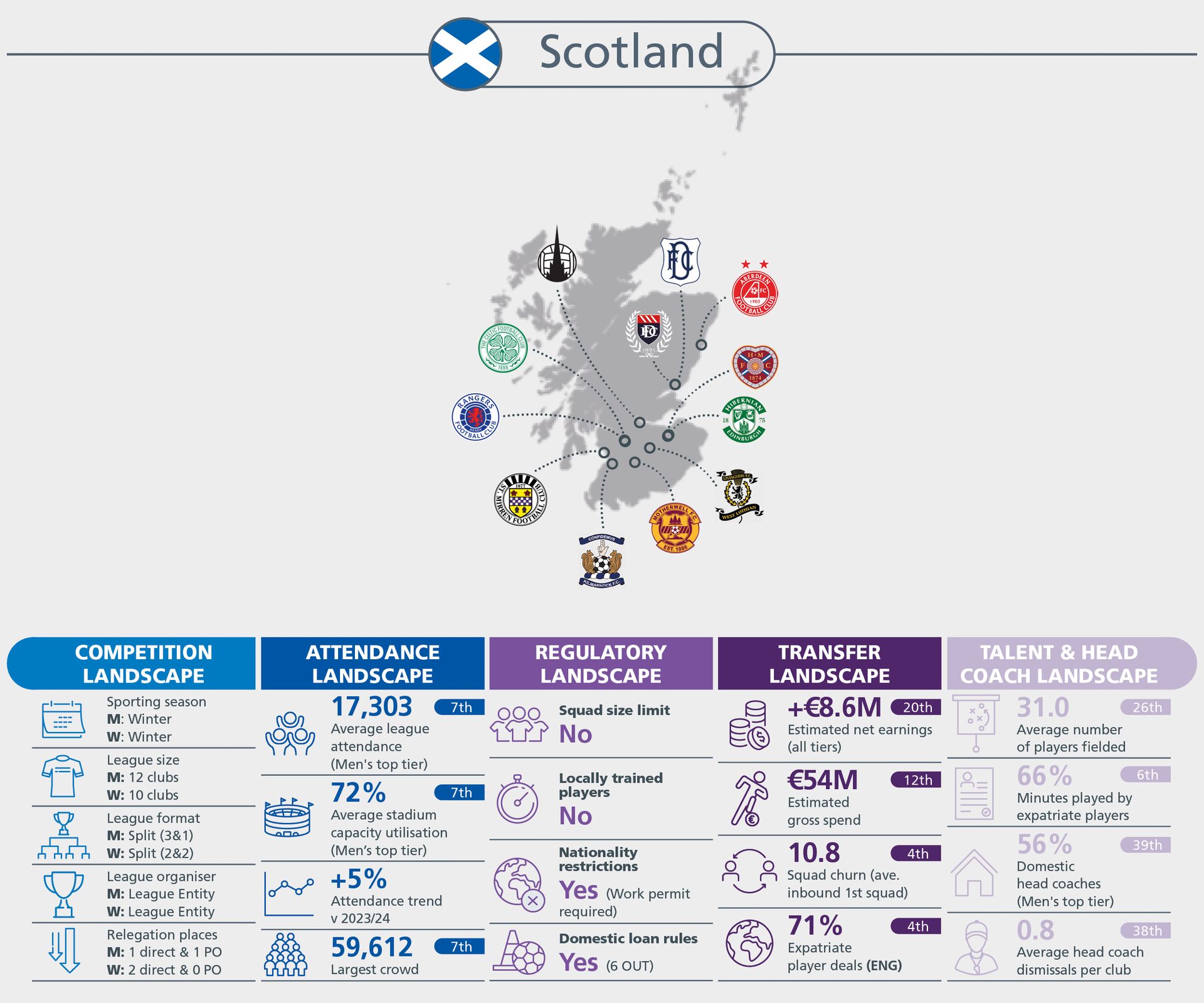

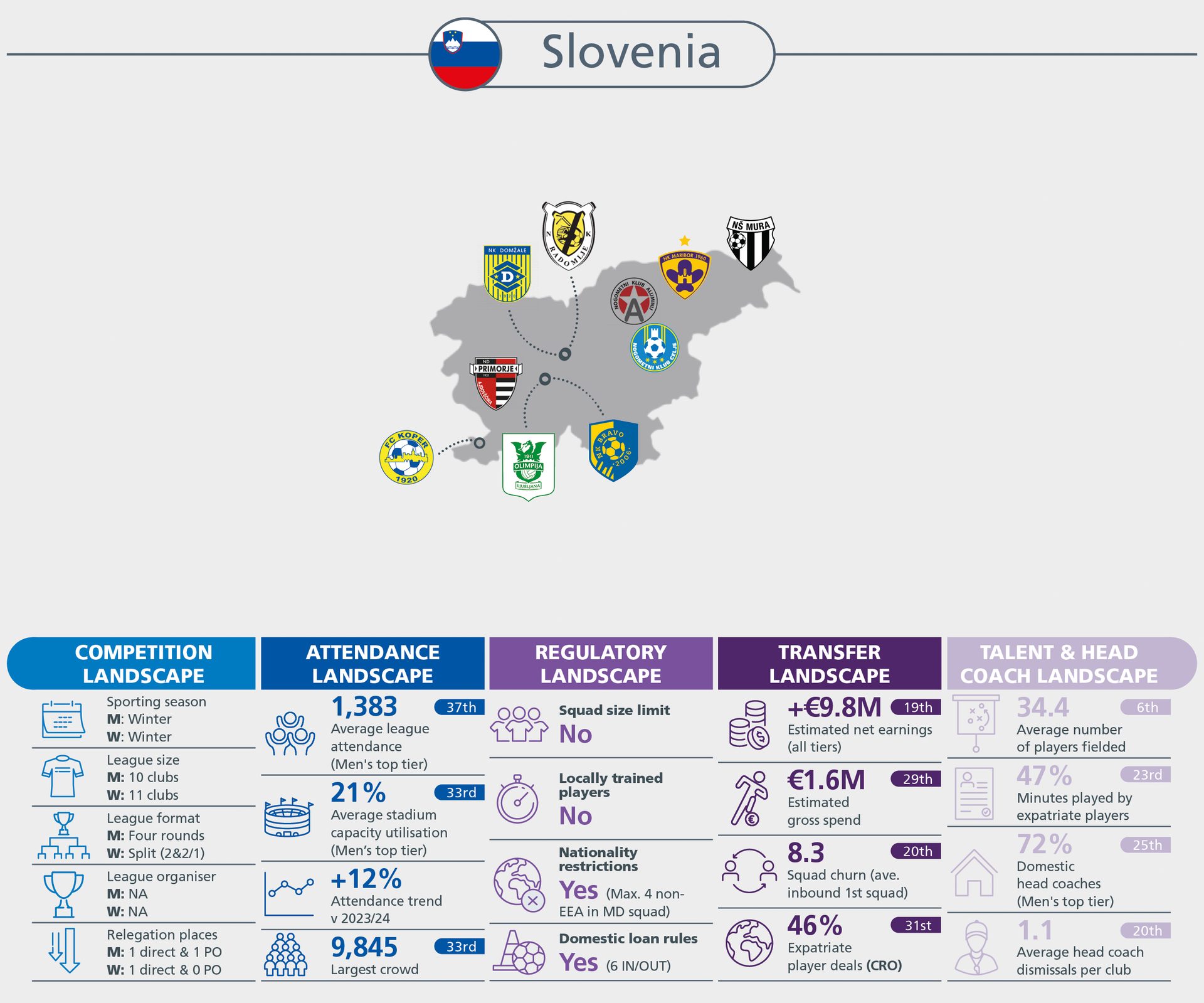

COUNTRY KPIs

The report covers much more than just the biggest clubs and leagues. More than 700 clubs are analysed each year, providing a 360-degree snapshot that can be explored below.

Iceland

Denmark

Norway

Sweden

Faroe Islands

Scotland

England

Wales

Republic of Ireland

Northern Ireland

Portugal

Gibraltar

Spain

Andorra

France

Belgium

Luxembourg

Netherlands

Germany

Finland

Russia

Kazakhstan

Azerbaijan

Armenia

Georgia

Turkey

Poland

Cyprus

Israel

Ukraine

Belarus

Lithuania

Latvia

Estonia

Slovakia

Hungary

Bosnia & Herzegovina

Kosovo

North Macedonia

Greece

Albania

Montenegro

Croatia

Slovenia

Austria

Czechia

Switzerland

San Marino

Italy

Malta

Romania

Moldova

Bulgaria

Serbia

Click on each country to view benchmark statistics.

10%

of head coaches were at a club from their own country

Benchmark

statistics

Click on each country to view benchmark statistics